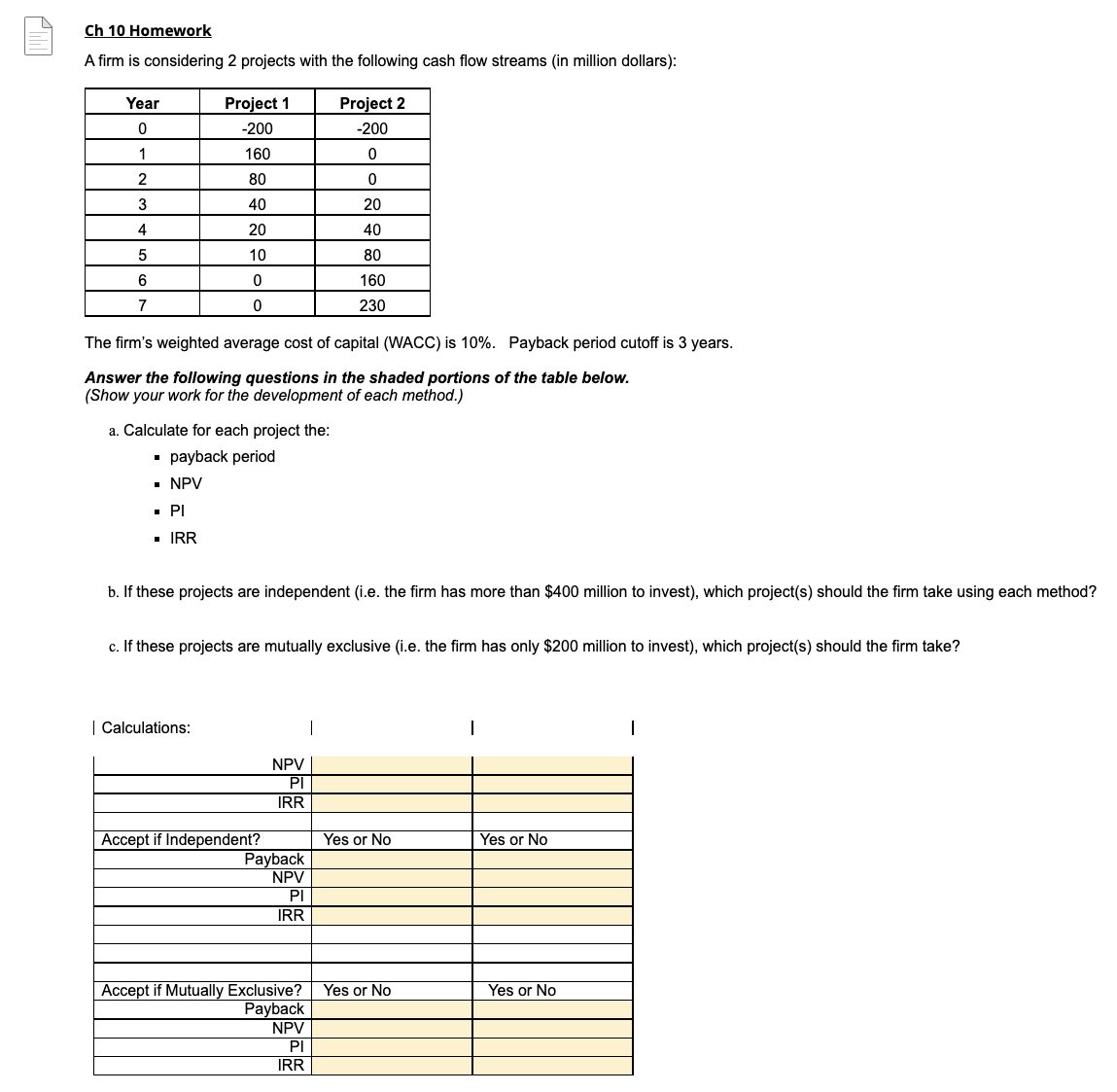

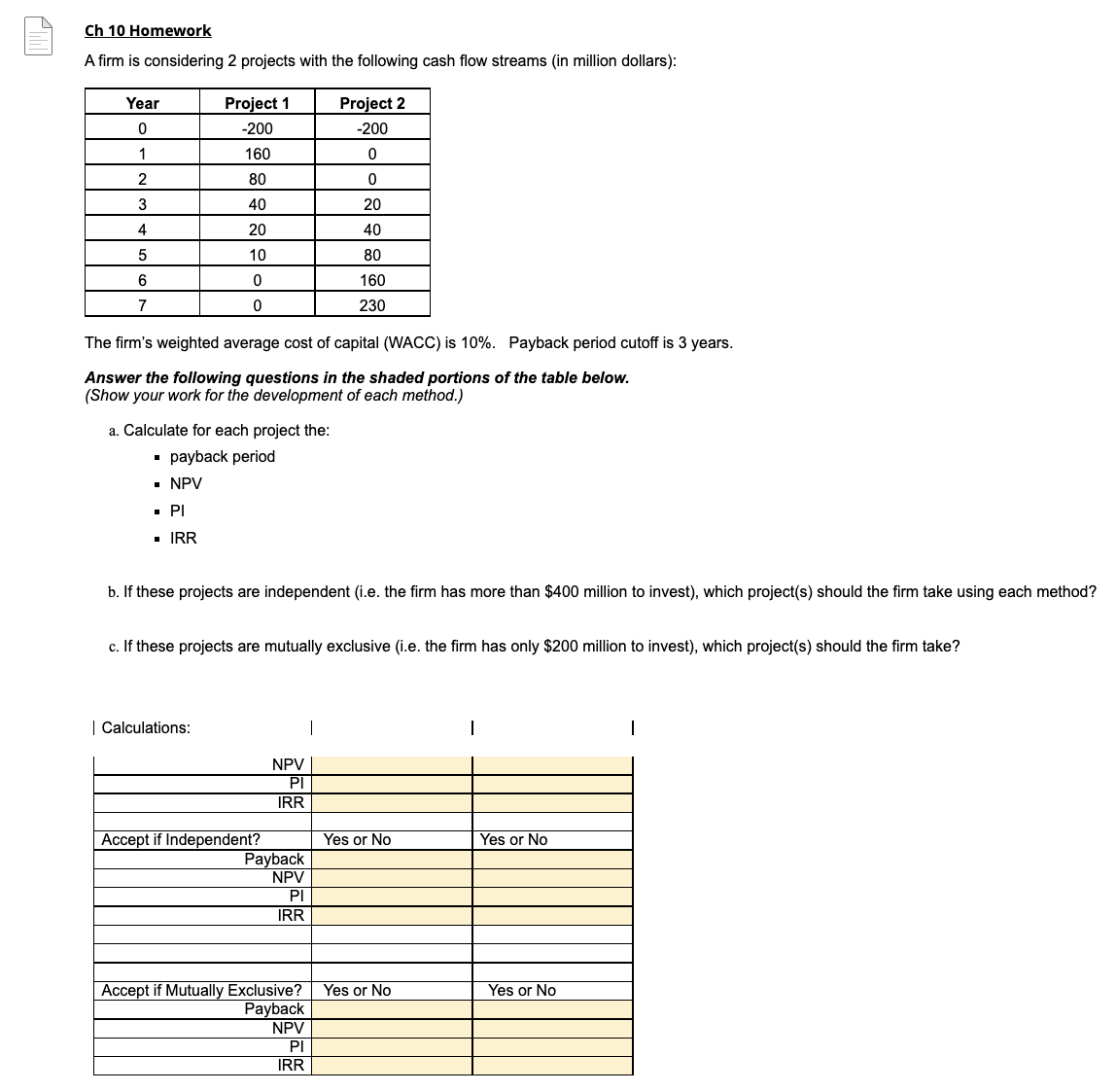

Question: D ch 10 Homework Afin'n is considering 2 projects with the following cash flow streams (in million dollars): The rm's weighted average cost of capital

D ch 10 Homework Afin'n is considering 2 projects with the following cash flow streams (in million dollars): The rm's weighted average cost of capital (WACC) is 10%. Payback period cutoff is 3 years. Answer the following questions in the shaded portions of the table below. (Show your work for the development of each method.) 3. Calculate for each project the: - payback period - NPV - Pl - IRR b. If these projects are independent {i.e. the firm has more than $400 million to invest), which project(s) should the rm take using each method? 0. If these projects are mutually exclusive (i.e. the rm has only $200 million to invest}, which project(s} should the rm take? Calculations: | | NPV Pl IRR Accept if Independent? Yes or No Payback NPV Pl IRR Accept if Mutually Exclusive? Yes or No Payback NPV Pl IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts