Question: d Chrome File Edit View History Bookmarks Proles Tab Window Help . . a Lesson 'l'lecoountingC x l 9 Lesson 10: Earnings per x l

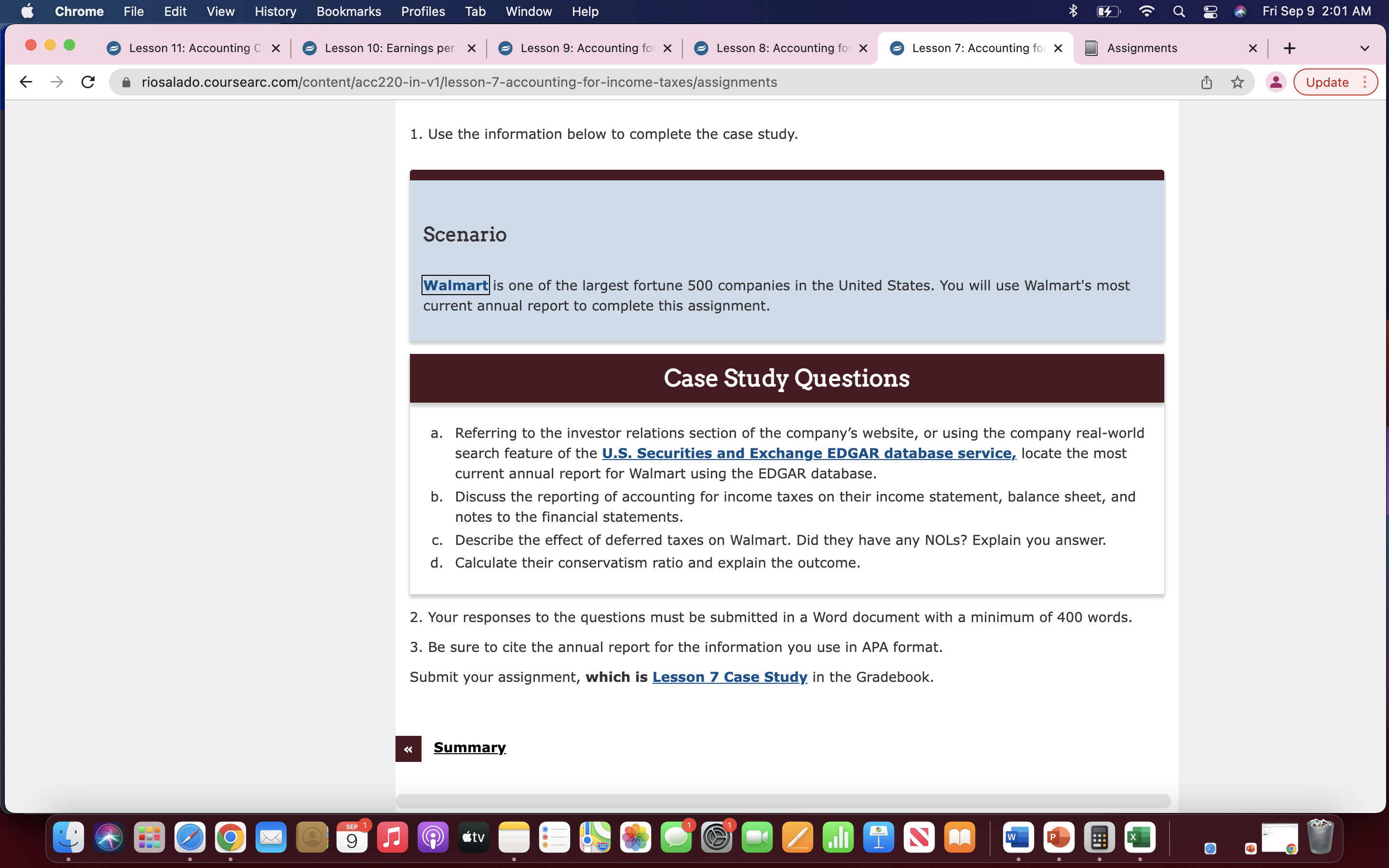

d Chrome File Edit View History Bookmarks Proles Tab Window Help . . a Lesson 'l'lecoountingC x l 9 Lesson 10: Earnings per x l a Lesson 9: Accountingfo X l a Lesson 82Accountingfo X a Lesson 7: Accounting ft x Assignments 6 9 C 6 riosalado.coursearc.com/content/acc220inv1/lesson7accountingforincometaxes/assignments 1. Use the information below to complete the case study. Scenario -is one of the largest fortune 500 companies in the United States. You will use Walmart's most current annual report to complete this assignment. Case Study Ques ions Referring to the investor relations section of the company's website, or using the company real-world search feature of the U.S. Securities and Exchange EDGAR database service, locate the most current annual report for Walmart using the EDGAR database. Discuss the reporting of accounting for income taxes on their income statement, balance sheet, and notes to the financial statements. Describe the effect of deferred taxes on Walmart. Did they have any NOLs? Explain you answer: Calculate their conservatism ratio and explain the outcome. 2. Your responses to the questions must be submitted in a Word document with a minimum of 400 words. 3. Be sure to cite the annual report for the information you use in APA format. Submit your assignment, which is Lesson 7 Case Study in the Gradebook. I Summary 'n@migo@mfa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts