Question: D D Question 21 4 pts Adamson will pay a dividend of $1.6 per share at the end of this year, the dividend will grow

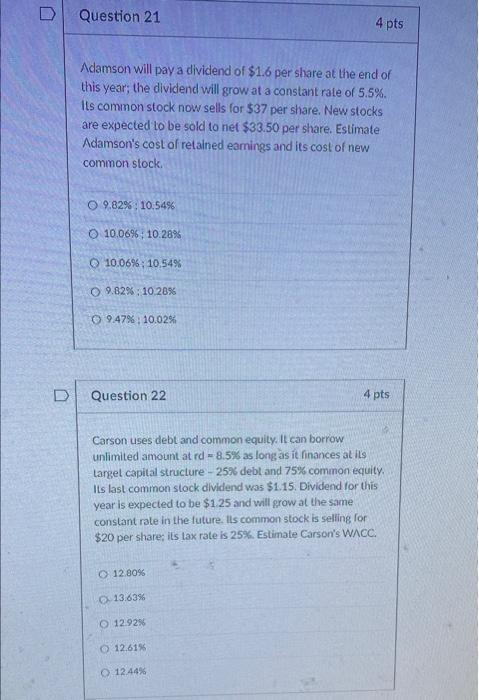

D D Question 21 4 pts Adamson will pay a dividend of $1.6 per share at the end of this year, the dividend will grow at a constant rate of 5.5%. Ils common stock now sells for $37 per share. New stocks are expected to be sold to net $33.50 per share. Estimate Adamson's cost of retained earnings and its cost of new common stock 9.82%: 10.54% O 10.06%: 10.28% 10.06%: 10.54% 9.82%: 10.28% 09.47%: 10.02% U Question 22 4 pts Carson uses debt and common equity. It can borrow unlimited amount at rd = 8.5% as long as it finances at its Largel capital structure - 25% debt and 75% common equity Ils last common stock dividend was $1.15. Dividend for this year is expected to be $1.25 and will grow at the same constant role in the future. Ils common stock is selling for $20 per share; its tax rate is 25%. Estimate Carson's WACC. 12 80% 13.6396 O 129256 12.615 12.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts