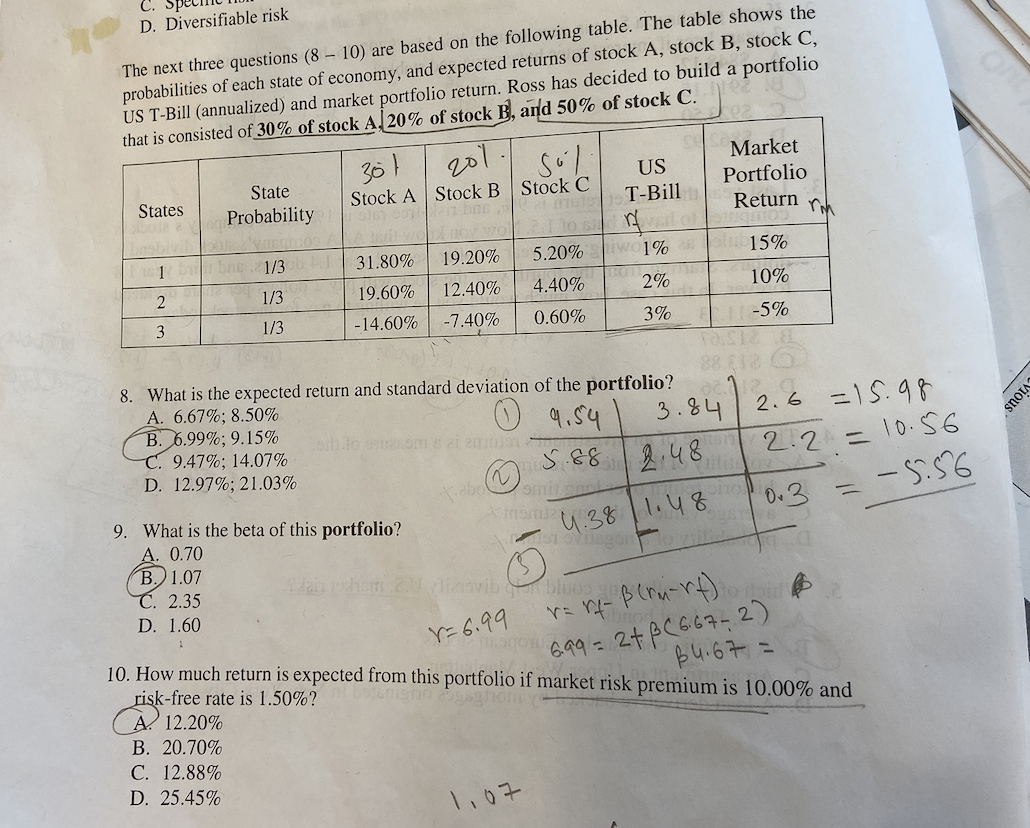

Question: D. Diversifiable risk The next three questions (8 - 10) are based on the following table. The table shows the probabilities of each state of

D. Diversifiable risk The next three questions (8 - 10) are based on the following table. The table shows the probabilities of each state of economy, and expected returns of stock A, stock B, stock C, US T-Bill (annualized) and market portfolio return. Ross has decided to build a portfolio that is consisted of 30% of stock A. 20% of stock B, and 50% of stock C. 201. Stock C mol T-Bill 301 Market Portfolio Return r. US State Stock A Stock B States Probability iwo1% bne 1/3 15% 5.20% 31.80% 19.20% 19.60% 4.40% 12.40% 1/3 10% 3 1/3 -14.60% 0.60% -7.40% 3% L11-5% 88.(12 O 8. What is the expected return and standard deviation of the portfolio? A. 6.67%; 8.50% B. 6.99%; 9.15% C. 9.47%; 14.07% O 9.54 2.6 =15.98 3.84 2.2 = 10.56 2.48 D. 12.97%; 21.03% mirsm 4.38 |1.48 gon 0.3 9. What is the beta of this portfolio? A. 0.70 B.) 1.07 C. 2.35 IST inavib bluos D. 1.60 Y=6.99 10. How much return is expected from this portfolio if market risk premium is 10.00% and 699 = 24PCG67=2) B4.67 = risk-free rate is 1.50%? A. 12.20% B. 20.70% C. 12.88% D. 25.45% 1.07 Vious

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts