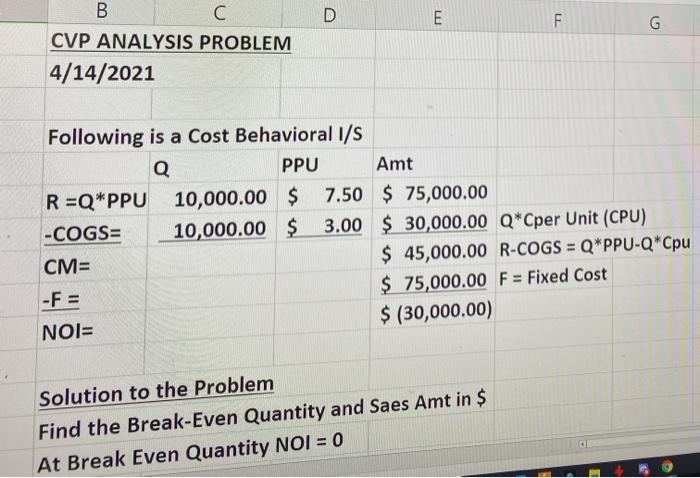

Question: D E F F G B C CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral I/S Q PPU Amt R=Q*PPU 10,000.00 $ 7.50 $

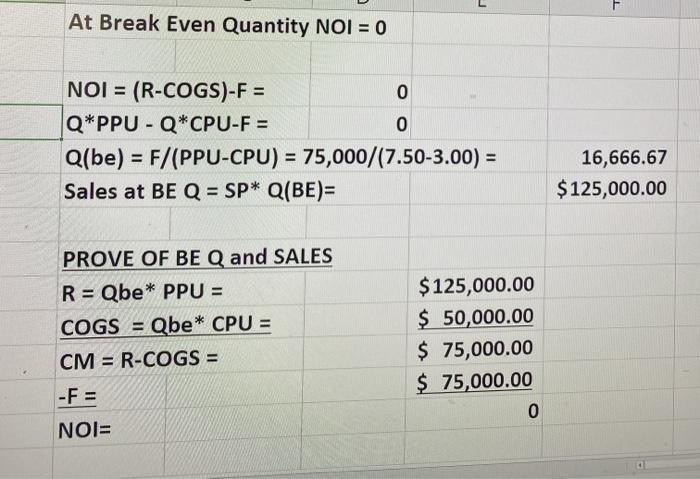

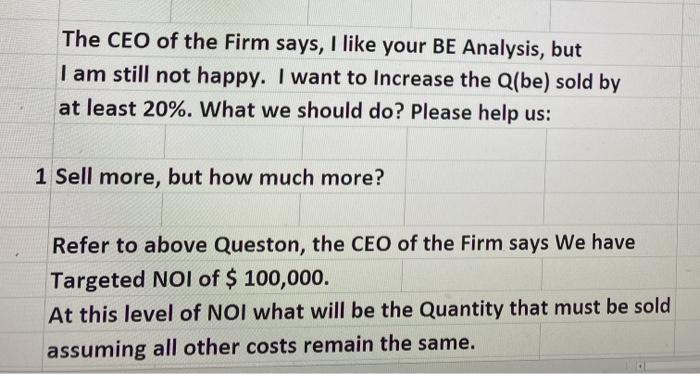

D E F F G B C CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral I/S Q PPU Amt R=Q*PPU 10,000.00 $ 7.50 $ 75,000.00 -COGS 10,000.00 $ 3.00 $ 30,000.00 Q* Cper Unit (CPU) CM= $ 45,000.00 R-COGS = Q*PPU-Q*Cpu -F = $ 75,000.00 F = Fixed Cost NOI= $ (30,000.00) Solution to the Problem Find the Break-Even Quantity and Saes Amt in $ At Break Even Quantity NOI = 0 T At Break Even Quantity NOI = 0 NOI = (R-COGS)-F = 0 Q*PPU - Q*CPU-F = 0 Q(be) = F/(PPU-CPU) = 75,000/(7.50-3.00) = Sales at BE Q = SP* Q(BE)= 16,666.67 $125,000.00 PROVE OF BE Q and SALES R = Qbe* PPU = COGS = Qbe* CPU = CM = R-COGS = $125,000.00 $ 50,000.00 $ 75,000.00 $ 75,000.00 0 -F = NOI= The CEO of the Firm says, I like your BE Analysis, but I am still not happy. I want to Increase the Q(be) sold by at least 20%. What we should do? Please help us: 1 Sell more, but how much more? Refer to above Queston, the CEO of the Firm says We have Targeted NOI of $ 100,000. At this level of NOI what will be the Quantity that must be sold assuming all other costs remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts