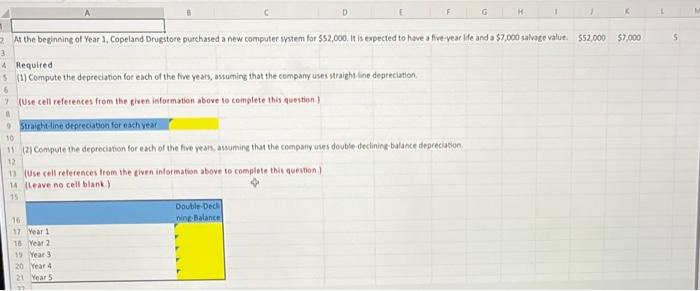

Question: D E F G H 1 K L At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It

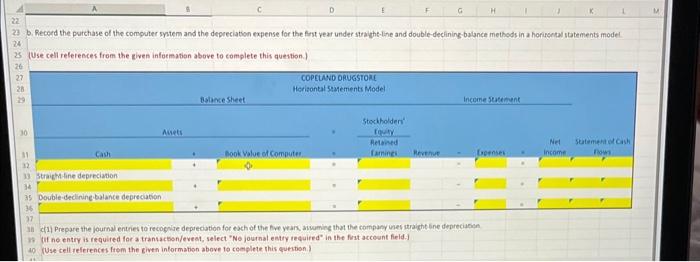

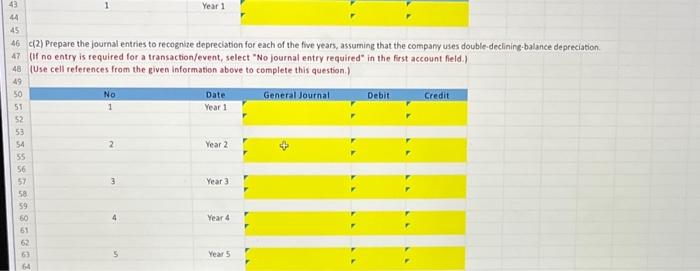

D E F G H 1 K L At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. $52,000 $7,000 S 3 4 Required 5 (1) Compute the depreciation for each of the five years, assuming that the company uses straight-line depreciation 6 7 (Use cell references from the given information above to complete this question.) Straight-line depreciation for each year 10 11 (2) Compute the depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation 12 13 (Use cell references from the given information above to complete this question.) 14 (Leave no cell blank) 15 16 17 Year 1 18 Year 2 19 Year 3 20 Year 4 21 Year 5 Double-Decl ning-Balance D E F G H " K L 22 24 23 b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining balance methods in a horizontal statements model. 25 (Use cell references from the given information above to complete this question.) 26 27 28 29 30 31 32 COPELAND DRUGSTORE Horizontal Statements Model Balance Sheet Income Statement Stockholders' Assets Equity Retained Net Statement of Cash Cash Book Value of Computer famings Revenue Expenses Income nows 33 Straight-line depreciation 34 35 Double-declining balance depreciation 36 37 38 (1) Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight line depreciation 39 (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 40 (Use cell references from the given information above to complete this question.) 43 44 45 1 Year 1 46 c(2) Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation. 47 (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 48 (Use cell references from the given information above to complete this question.) 49 50 51 52 53 54 55 56 57 58 SESSEGGE 59 No 1 Date Year 1 General Journal Year 2 Year 3 60 Year 4 61 62 63 Year 5 64 Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts