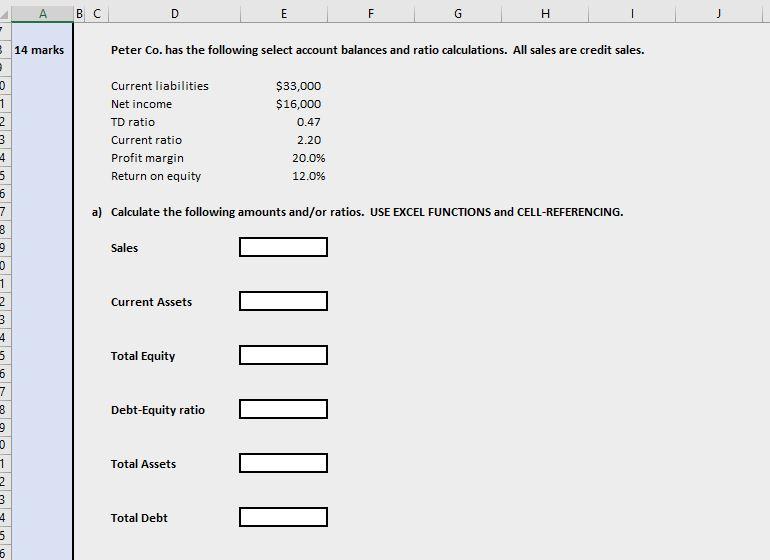

Question: D E F G H J 14 marks Peter Co. has the following select account balances and ratio calculations. All sales are credit sales. 0

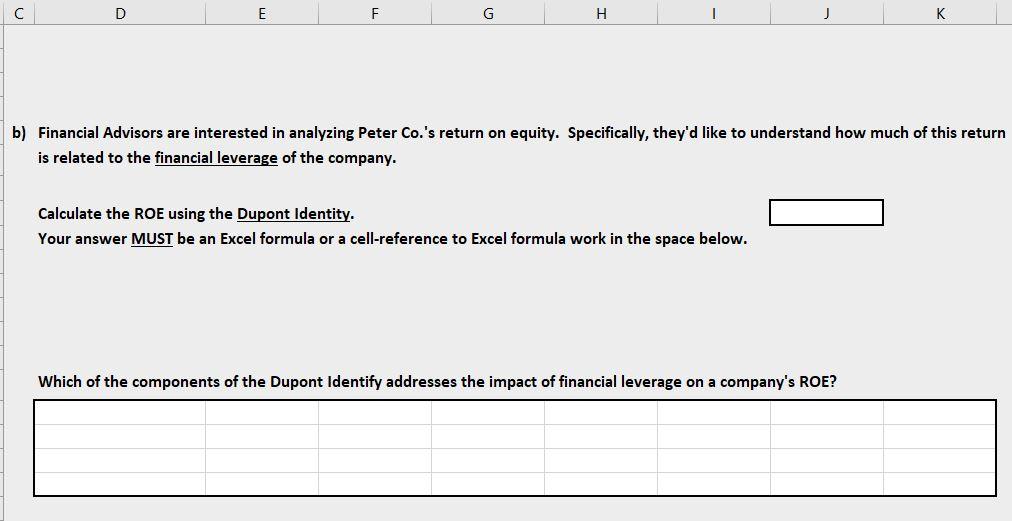

D E F G H J 14 marks Peter Co. has the following select account balances and ratio calculations. All sales are credit sales. 0 Current liabilities $33,000 $16,000 1 Net income 2 TD ratio 0.47 3 Current ratio 2.20 4 Profit margin 20.0% 5 Return on equity 12.0% 6 7 a) Calculate the following amounts and/or ratios. USE EXCEL FUNCTIONS and CELL-REFERENCING. 8 9 Sales 0 1 2 Current Assets 3 4 5 Total Equity 6 111101 7 8 Debt-Equity ratio 9 D 1 Total Assets 2 3 4 Total Debt 5 6 D E F G H K b) Financial Advisors are interested in analyzing Peter Co.'s return on equity. Specifically, they'd like to understand how much of this return is related to the financial leverage of the company. Calculate the ROE using the Dupont Identity. Your answer MUST be an Excel formula or a cell-reference to Excel formula work in the space below. Which of the components of the Dupont Identify addresses the impact of financial leverage on a company's ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts