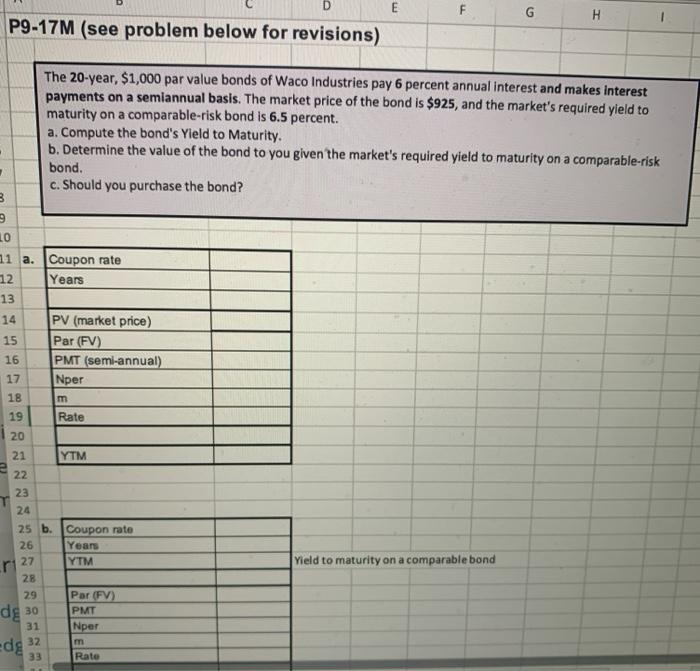

Question: D E F G H P9-17M (see problem below for revisions) 7 The 20-year, $1,000 par value bonds of Waco Industries pay 6 percent annual

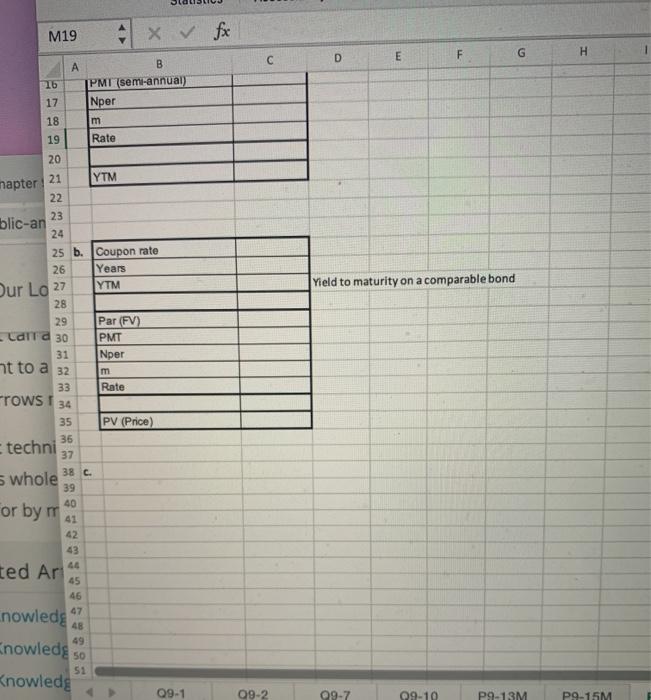

D E F G H P9-17M (see problem below for revisions) 7 The 20-year, $1,000 par value bonds of Waco Industries pay 6 percent annual interest and makes interest payments on a semiannual basis. The market price of the bond is $925, and the market's required yield to maturity on a comparable-risk bond is 6.5 percent. a. Compute the bond's Yield to Maturity. . b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? 3 9 LO 11 a. Coupon rate 12 Years 13 14 PV (market price) 15 16 PMT (semi-annual) 17 Nper 18 m 19 Rate 20 Par (FV) 21 YTM 22 23 24 Yield to maturity on a comparable bond 25 b. Coupon rate 26 Years ri 27 YTM 28 29 Par (FV) PMT 31 edg 32 m 33 Rate de 30 Nper M19 X & fx D F E H G 16 17 B PMT semi-annual) Nper m Rate 18 19 20 YTM napter 21 22 Our Lo 27 Yield to maturity on a comparable bond 23 blic-an 24 25 b. Coupon rate 26 Years YTM 28 29 Par (FV) - Carta 30 PMT 31 Nper nt to a 32 m 33 Rate rows 34 35 PV (Price) 35 techni 37 38 c. 5 whole 39 40 or by 41 42 43 46 ted Ar 45 46 47 nowledge 48 nowleda so 51 Knowledg 09-1 09-2 09-7 09-10 P9-13M P9-15M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts