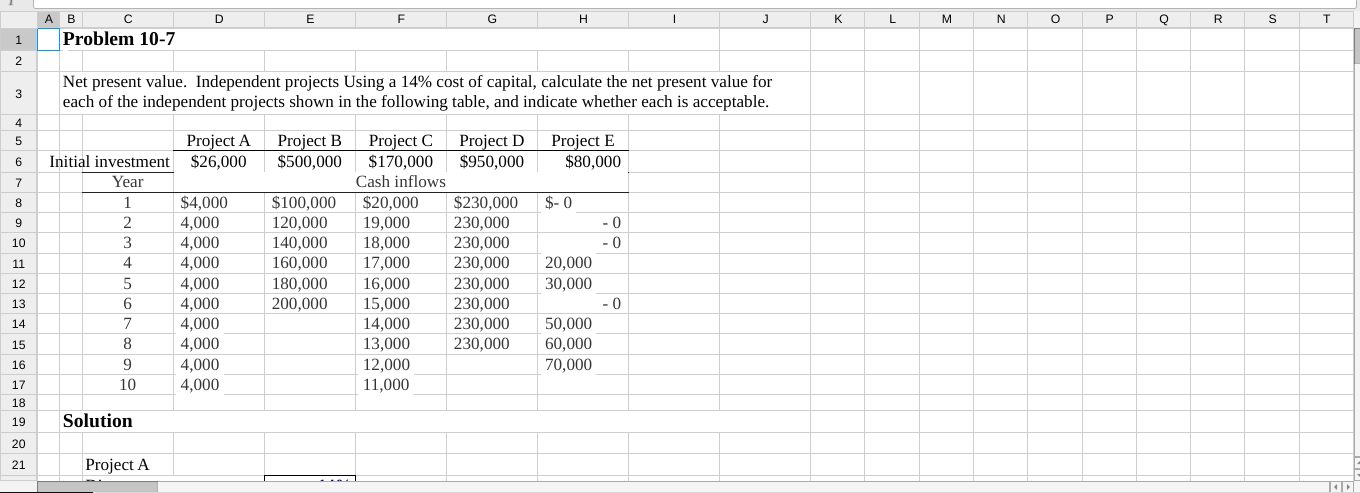

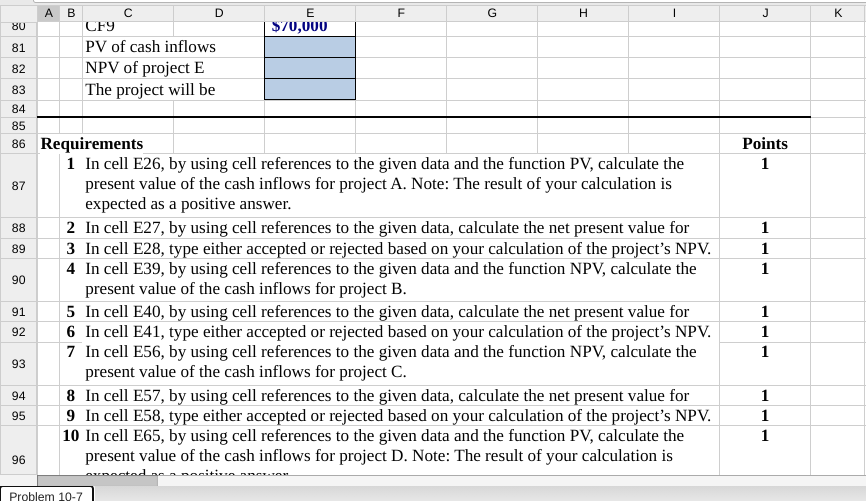

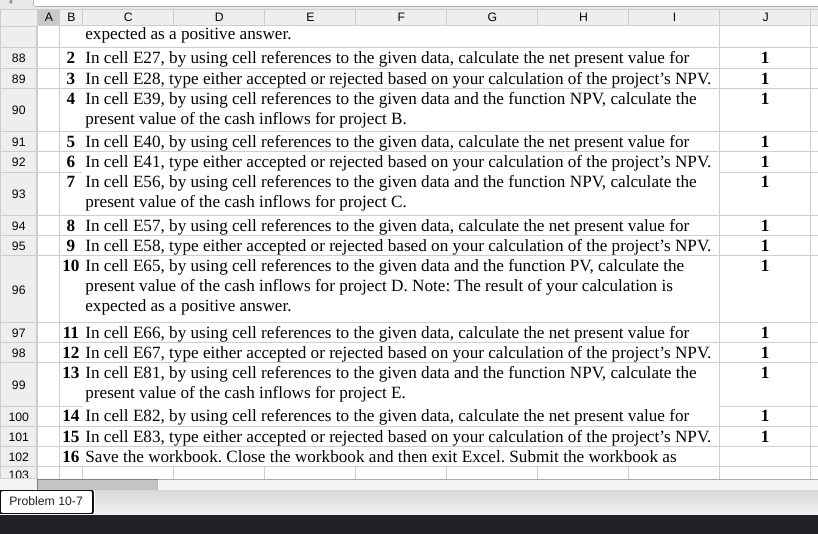

Question: D E F G . | J K L M N o P Q R S T Problem 10-7 1 2 3 Net present value.

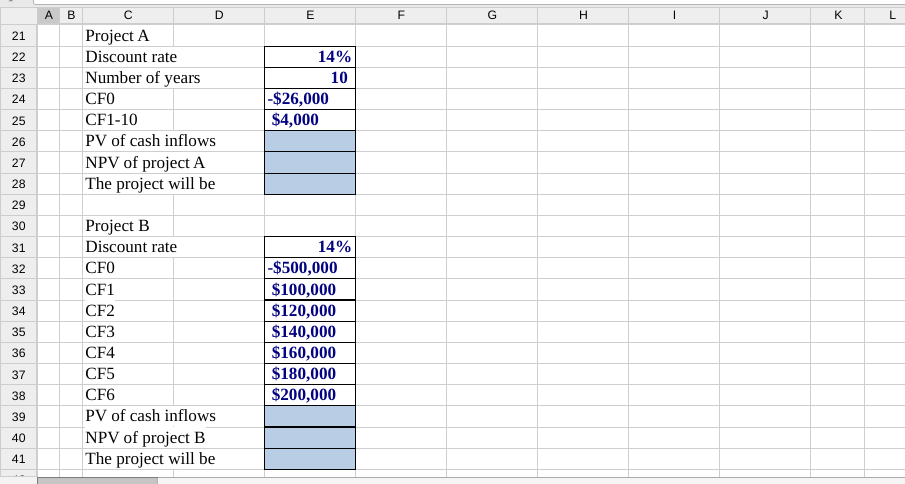

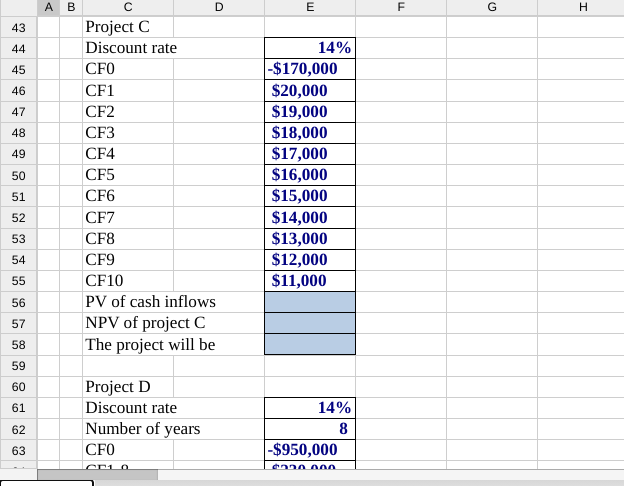

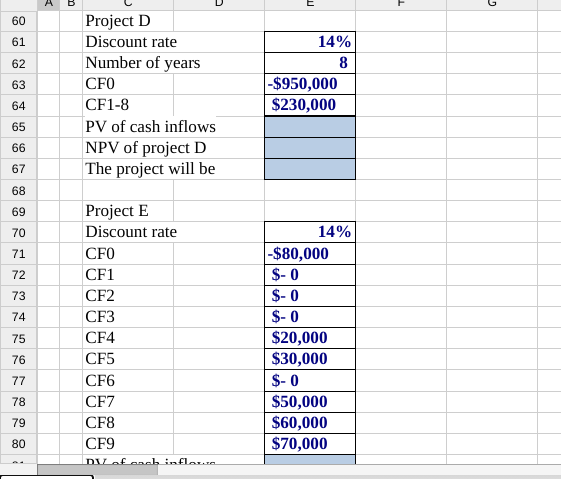

D E F G . | J K L M N o P Q R S T Problem 10-7 1 2 3 Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. 4 5 Project A $26,000 Project B $500,000 Project E $80,000 6 7 8 $-0 9 -0 -0 10 Initial investment Year 1 2 3 4 5 6 7 8 9 10 11 $100,000 120,000 140,000 160.000 180,000 200,000 Project C Project D $170,000 $950,000 Cash inflows $20,000 $230,000 19,000 230,000 18,000 230,000 17,000 230,000 16,000 230,000 15,000 230,000 14,000 230,000 13,000 230,000 12,000 11,000 $4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 20,000 30,000 12 13 0 14 15 50,000 60,000 70,000 16 17 18 19 Solution 20 21 Project A A B D E TI G H J K 21 22 23 Project A Discount rate Number of years CFO CF1-10 PV of cash inflows NPV of project A The project will be 14% 10 - $26,000 $4,000 24 25 26 27 28 29 30 31 32 33 34 Project B Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 PV of cash inflows NPV of project B The project will be 14% -$500,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 35 36 37 38 39 40 41 A B D E TI G I 43 44 45 46 47 48 49 Project C Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 CF10 PV of cash inflows NPV of project C The project will be 14% -$170,000 $20,000 $19,000 $18,000 $17,000 $16,000 $15,000 $14,000 $13,000 $12,000 $11,000 50 51 52 53 54 55 56 57 58 59 60 61 Project D Discount rate Number of years CFO 62 14% 8 -$950,000 63 cnnnnnn A E 60 61 62 Project D Discount rate Number of years CFO CF1-8 PV of cash inflows NPV of project D The project will be 14% 8 -$950,000 $230,000 63 64 65 66 67 68 69 70 71 72 73 74 75 Project E Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 Dofocb inflorire 14% -$80,000 $-0 $-0 $- 0 $20,000 $30,000 $-0 $50,000 $60,000 $70,000 76 77 78 79 80 2 A B D TI G . J K 80 E $70,000 81 CF9 PV of cash inflows NPV of project E The project will be 82 83 84 85 Points 1 88 89 1 1 1 90 86 Requirements 1 In cell E26, by using cell references to the given data and the function PV, calculate the 87 present value of the cash inflows for project A. Note: The result of your calculation is expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. 10 In cell E65, by using cell references to the given data and the function PV, calculate the 96 present value of the cash inflows for project D. Note: The result of your calculation is 91 92 1 1 1 93 94 95 1 1 1 Doctoda docitivo Con Problem 10-7 A B D E F G H J 88 89 1 1 1 90 91 92 1 1 1 93 94 95 expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. 10 In cell E65, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project D. Note: The result of your calculation is expected as a positive answer. 11 In cell E66, by using cell references to the given data, calculate the net present value for 12 In cell E67, type either accepted or rejected based on your calculation of the project's NPV. 13 In cell E81, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project E. 14 In cell E82, by using cell references to the given data, calculate the net present value for 15 In cell E83, type either accepted or rejected based on your calculation of the project's NPV. 16 Save the workbook. Close the workbook and then exit Excel. Submit the workbook as 1 1 1 96 97 98 1 1 1 99 100 101 1 1 102 103 Problem 10-7 D E F G . | J K L M N o P Q R S T Problem 10-7 1 2 3 Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. 4 5 Project A $26,000 Project B $500,000 Project E $80,000 6 7 8 $-0 9 -0 -0 10 Initial investment Year 1 2 3 4 5 6 7 8 9 10 11 $100,000 120,000 140,000 160.000 180,000 200,000 Project C Project D $170,000 $950,000 Cash inflows $20,000 $230,000 19,000 230,000 18,000 230,000 17,000 230,000 16,000 230,000 15,000 230,000 14,000 230,000 13,000 230,000 12,000 11,000 $4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 20,000 30,000 12 13 0 14 15 50,000 60,000 70,000 16 17 18 19 Solution 20 21 Project A A B D E TI G H J K 21 22 23 Project A Discount rate Number of years CFO CF1-10 PV of cash inflows NPV of project A The project will be 14% 10 - $26,000 $4,000 24 25 26 27 28 29 30 31 32 33 34 Project B Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 PV of cash inflows NPV of project B The project will be 14% -$500,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 35 36 37 38 39 40 41 A B D E TI G I 43 44 45 46 47 48 49 Project C Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 CF10 PV of cash inflows NPV of project C The project will be 14% -$170,000 $20,000 $19,000 $18,000 $17,000 $16,000 $15,000 $14,000 $13,000 $12,000 $11,000 50 51 52 53 54 55 56 57 58 59 60 61 Project D Discount rate Number of years CFO 62 14% 8 -$950,000 63 cnnnnnn A E 60 61 62 Project D Discount rate Number of years CFO CF1-8 PV of cash inflows NPV of project D The project will be 14% 8 -$950,000 $230,000 63 64 65 66 67 68 69 70 71 72 73 74 75 Project E Discount rate CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 Dofocb inflorire 14% -$80,000 $-0 $-0 $- 0 $20,000 $30,000 $-0 $50,000 $60,000 $70,000 76 77 78 79 80 2 A B D TI G . J K 80 E $70,000 81 CF9 PV of cash inflows NPV of project E The project will be 82 83 84 85 Points 1 88 89 1 1 1 90 86 Requirements 1 In cell E26, by using cell references to the given data and the function PV, calculate the 87 present value of the cash inflows for project A. Note: The result of your calculation is expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. 10 In cell E65, by using cell references to the given data and the function PV, calculate the 96 present value of the cash inflows for project D. Note: The result of your calculation is 91 92 1 1 1 93 94 95 1 1 1 Doctoda docitivo Con Problem 10-7 A B D E F G H J 88 89 1 1 1 90 91 92 1 1 1 93 94 95 expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. 10 In cell E65, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project D. Note: The result of your calculation is expected as a positive answer. 11 In cell E66, by using cell references to the given data, calculate the net present value for 12 In cell E67, type either accepted or rejected based on your calculation of the project's NPV. 13 In cell E81, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project E. 14 In cell E82, by using cell references to the given data, calculate the net present value for 15 In cell E83, type either accepted or rejected based on your calculation of the project's NPV. 16 Save the workbook. Close the workbook and then exit Excel. Submit the workbook as 1 1 1 96 97 98 1 1 1 99 100 101 1 1 102 103 Problem 10-7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts