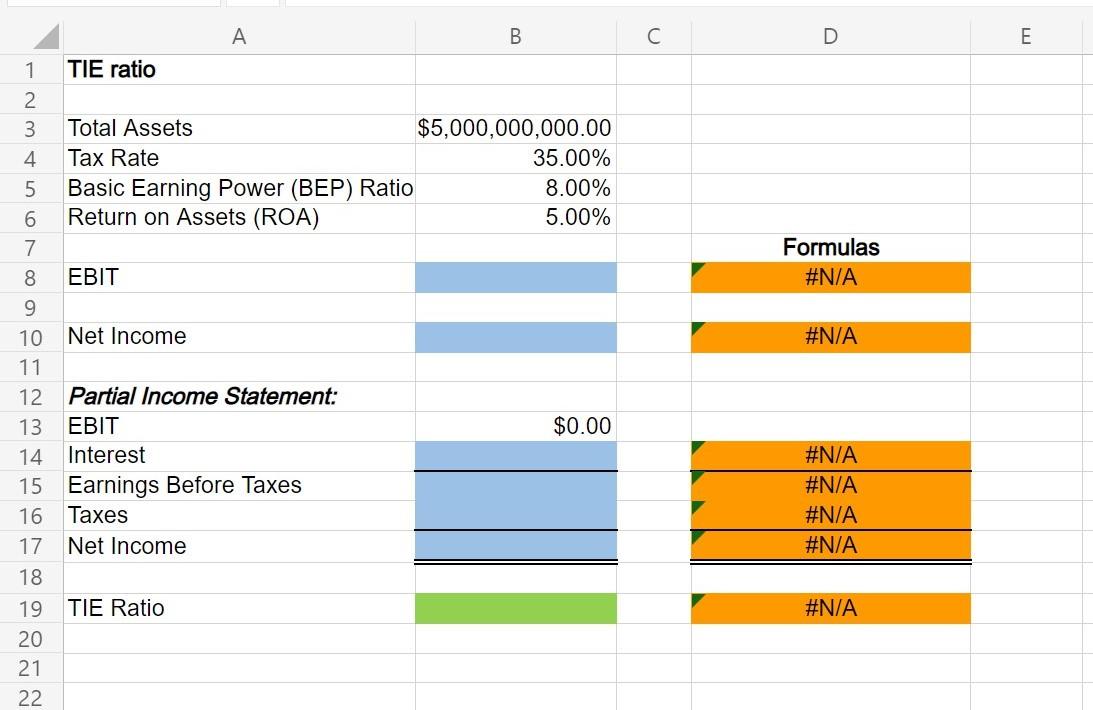

Question: D E Formulas #N/A #N/A A B 1 TIE ratio 2 3 Total Assets $5,000,000,000.00 4 Tax Rate 35.00% 5 Basic Earning Power (BEP) Ratio

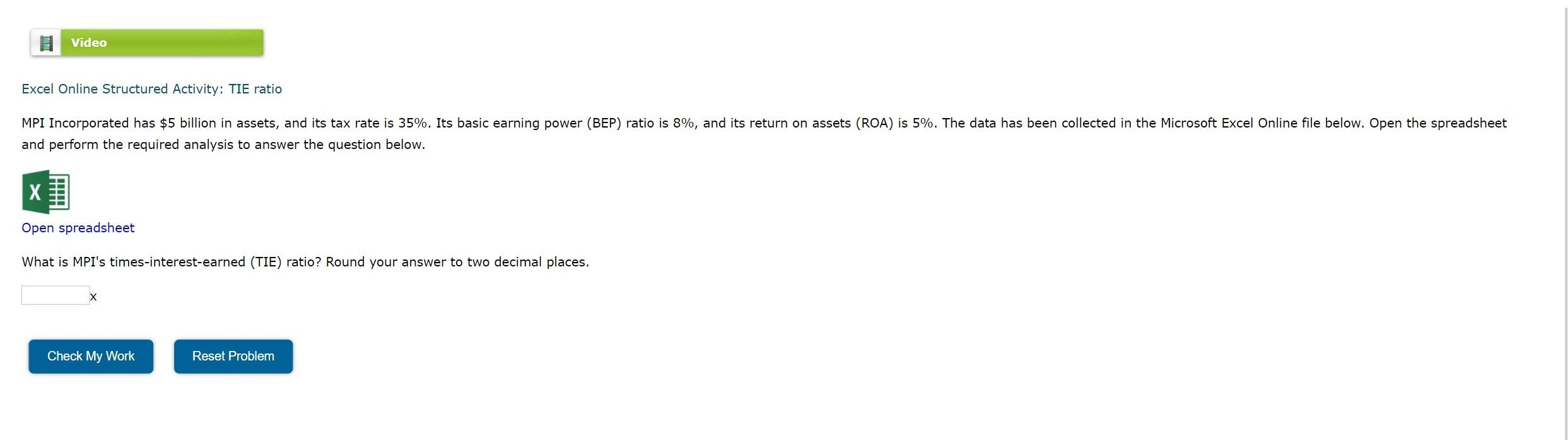

D E Formulas #N/A #N/A A B 1 TIE ratio 2 3 Total Assets $5,000,000,000.00 4 Tax Rate 35.00% 5 Basic Earning Power (BEP) Ratio 8.00% 6 Return on Assets (ROA) 5.00% 7 8 EBIT 9 10 Net Income 11 12 Partial Income Statement: 13 EBIT $0.00 14 Interest 15 Earnings Before Taxes 16 Taxes 17 Net Income 18 19 TIE Ratio 20 21 22 #N/A #N/A #N/A #N/A #N/A Video Excel Online Structured Activity: TIE ratio MPI Incorporated has $5 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 8%, and its return on assets (ROA) is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. X Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts