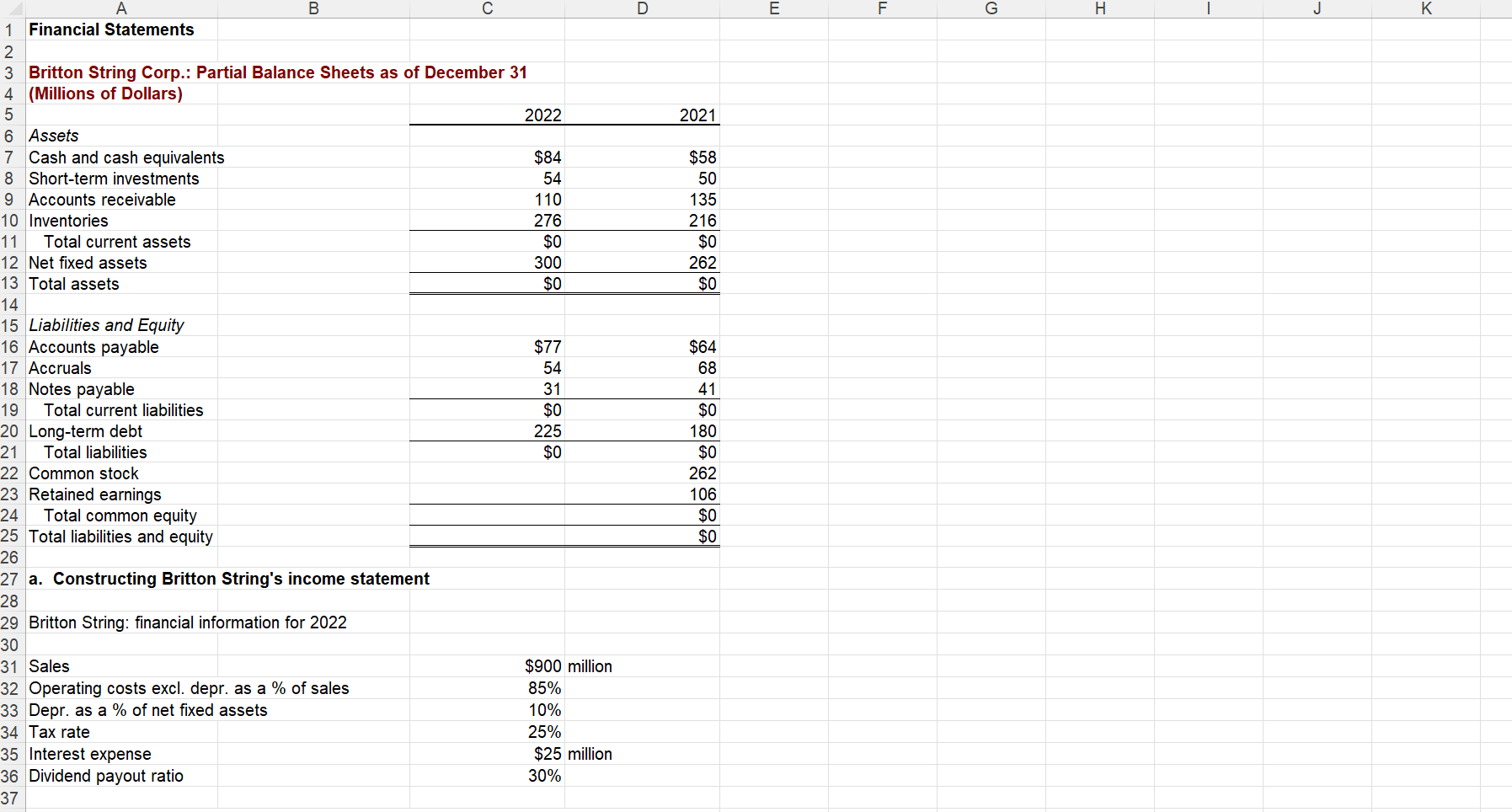

Question: D E G H 1 J K 2021 $58 50 135 216 $0 262 $0 A B 1 Financial Statements 2 3 Britton String Corp.:

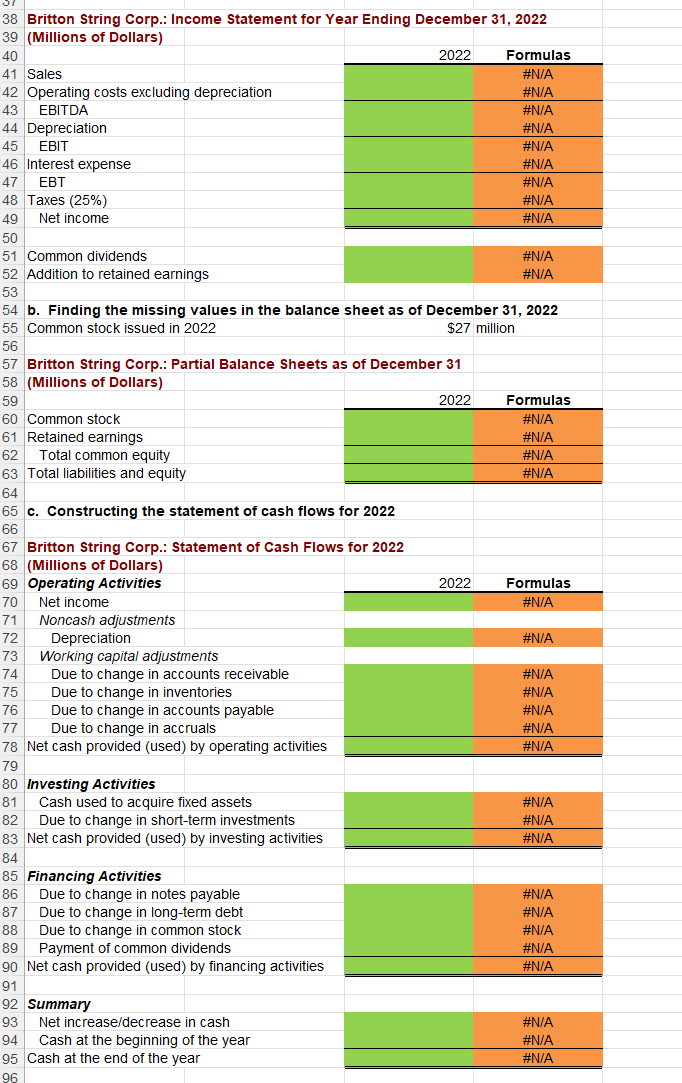

D E G H 1 J K 2021 $58 50 135 216 $0 262 $0 A B 1 Financial Statements 2 3 Britton String Corp.: Partial Balance Sheets as of December 31 4 (Millions of Dollars) 5 2022 6 Assets 7 Cash and cash equivalents $84 8 Short-term investments 54 9 Accounts receivable 110 10 Inventories 276 11 Total current assets $0 12 Net fixed assets 300 13 Total assets $0 14 15 Liabilities and Equity 16 Accounts payable $77 17 Accruals 54 18 Notes payable 31 19 Total current liabilities $0 20 Long-term debt 225 21 Total liabilities $0 22 Common stock 23 Retained earnings 24 Total common equity 25 Total liabilities and equity 26 27 a. Constructing Britton String's income statement 28 29 Britton String: financial information for 2022 30 31 Sales $900 million 32 Operating costs excl. depr. as a % of sales 85% 33 Depr. as a % of net fixed assets 10% 34 Tax rate 25% 35 Interest expense $25 million 36 Dividend payout ratio 30% 37 $64 68 41 $0 180 $0 262 106 $0 $0 38 Britton String Corp.: Income Statement for Year Ending December 31, 2022 39 (Millions of Dollars) 40 2022 Formulas 41 Sales #N/A 42 Operating costs excluding depreciation #N/A 43 EBITDA #N/A 44 Depreciation #N/A 45 EBIT #N/A 46 Interest expense #N/A 47 EBT #N/A 48 Taxes (25%) #N/A 49 Net income #N/A 50 51 Common dividends #N/A 52 Addition to retained earnings #N/A 53 54 b. Finding the missing values in the balance sheet as of December 31, 2022 55 Common stock issued in 2022 $27 million 56 57 Britton String Corp.: Partial Balance Sheets as of December 31 58 (Millions of Dollars) 59 2022 Formulas 60 Common stock #N/A 61 Retained earnings #N/A 62 Total common equity #N/A 63 Total liabilities and equity #N/A 64 65 c. Constructing the statement of cash flows for 2022 66 67 Britton String Corp.: Statement of Cash Flows for 2022 68 (Millions of Dollars) 69 Operating Activities 2022 Formulas 70 Net income #N/A 71 Noncash adjustments 72 Depreciation #N/A 73 Working capital adjustments 74 Due to change in accounts receivable #N/A 75 Due to change in inventories #N/A N 76 Due to change in accounts payable #N/A 77 Due to change in accruals #N/A 78 Net cash provided (used) by operating activities #N/A 79 80 Investing Activities 81 Cash used to acquire fixed assets #N/A 82 Due to change in short-term investments #N/A 83 Net cash provided (used) by investing activities #N/A 84 85 Financing Activities 86 Due to change in notes payable #N/A 87 Due to change in long-term debt #N/A 88 Due to change in common stock #N/A 89 Payment of common dividends #N/A 90 Net cash provided (used) by financing activities #N/A 91 92 Summary 93 Net increase/decrease in cash #N/A 94 Cash at the beginning of the year #N/A 95 Cash at the end of the year #N/A 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts