Question: D E Note: This problem, this company is totally NOT related or connected to the previous company in any way. Company name: Cypress Inc. You

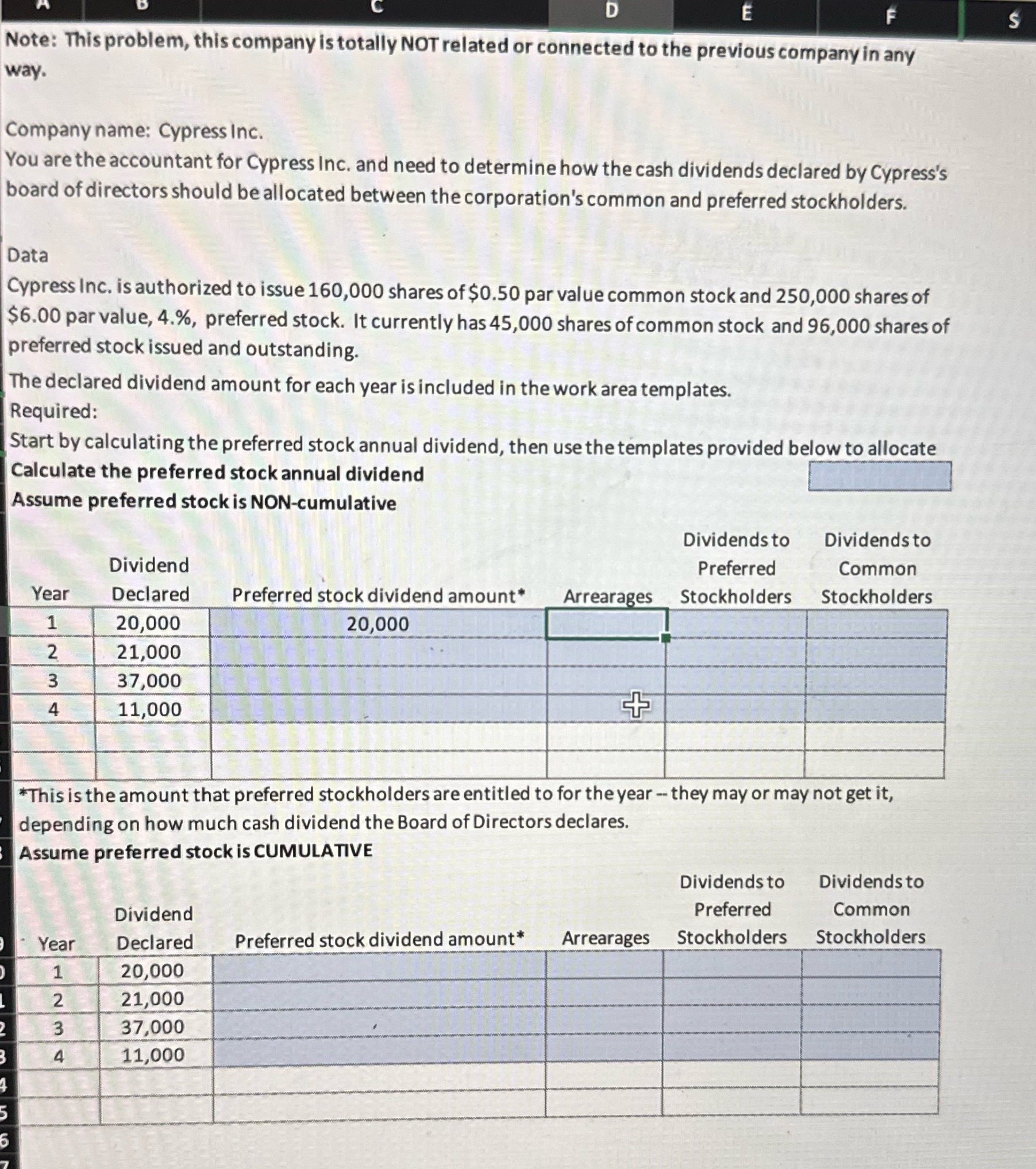

D E Note: This problem, this company is totally NOT related or connected to the previous company in any way. Company name: Cypress Inc. You are the accountant for Cypress Inc. and need to determine how the cash dividends declared by Cypress's board of directors should be allocated between the corporation's common and preferred stockholders. Data Cypress Inc. is authorized to issue 160,000 shares of $0.50 par value common stock and 250,000 shares of $6.00 par value, 4.%, preferred stock. It currently has 45,000 shares of common stock and 96,000 shares of preferred stock issued and outstanding. The declared dividend amount for each year is included in the work area templates. Required: Start by calculating the preferred stock annual dividend, then use the templates provided below to allocate Calculate the preferred stock annual dividend Assume preferred stock is NON-cumulative Dividends to Dividends to Dividend Preferred Common Year Declared Preferred stock dividend amount* Arrearages Stockholders Stockholders 1 20,000 20,000 2 21,000 3 37,000 4 11,000 + *This is the amount that preferred stockholders are entitled to for the year -- they may or may not get it, depending on how much cash dividend the Board of Directors declares. Assume preferred stock is CUMULATIVE Dividends to Dividends to Dividend Preferred Common Stockholders Stockholders Year Declared Preferred stock dividend amount* Arrearages 1 20,000 2 21,000 W 37,000 4 11,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts