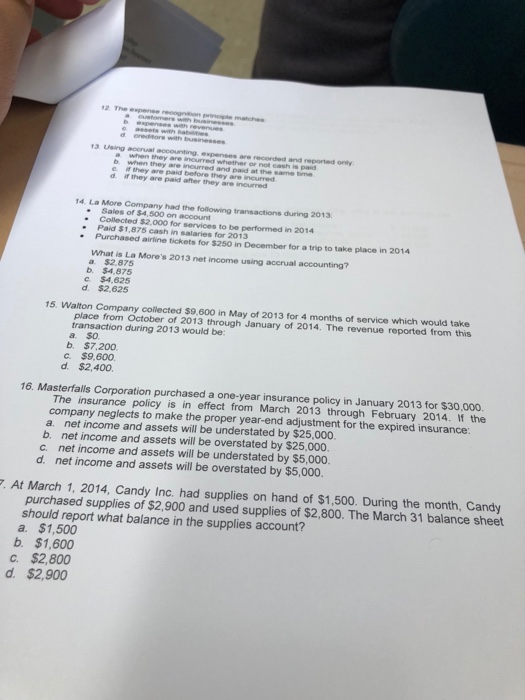

Question: d ereators with and reported only incurred whether or not cash is paid b. when they are inourred and paid at the same d. if

d ereators with and reported only incurred whether or not cash is paid b. when they are inourred and paid at the same d. if they are paid ater they are incurred 14. La More Company had the following transactions during 2013 Sales of $4,500 on account Paid $1,875 cash in salaries for 2013 -Collected $2,000 for services to be performed in 2014 Purchased airline tickets for $250 in December for a trip to take place in 2014 What is La More's 2013 net income using accrual accounting? a $2,875 b. $4,875 c $4,625 d. $2,625 15. Walton Company collected $9,600 in May of 2013 for 4 months of service which would take place from October of 2013 through January of 2014. The revenue reported from this transaction during 2013 would be: b. $7,200 c $9,600 d. $2,400. 16. Masterfalls Corporation purchased a one-year insurance policy in January 2013 for $30,000. The insurance policy is in effect from March 2013 through February 2014. If the company neglects to make the proper year-end adjustment for the expired insurance: a. net income and assets will be understated by $25,000 b. net income and assets will be overstated by $25,000. c. net income and assets will be understated by $5,000. d net income and assets will be overstated by $5,000. . At March 1, 2014, Candy Inc. had supplies on hand of $1,500. During the month, Candy purchased supplies of $2,900 and used supplies of $2,800. The March 31 balance sheet should report what balance in the supplies account? a. $1,500 b. $1,600 c. $2,800 d. $2,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts