Question: (d). Estimate the enterprise value using the economic profit model and compare it with the result of the DCF model. Assume economic profit grows at

(d). Estimate the enterprise value using the economic profit model and compare it with the result of the DCF model. Assume economic profit grows at 5 percent. (e). Calculate the intrinsic equity value for HH Plc using indirect approach. Does the intrinsic value per share differ from the share price in (d) above? (f). Discuss the main difference between direct and indirect approaches in equity valuation using both DCF and RIVM.

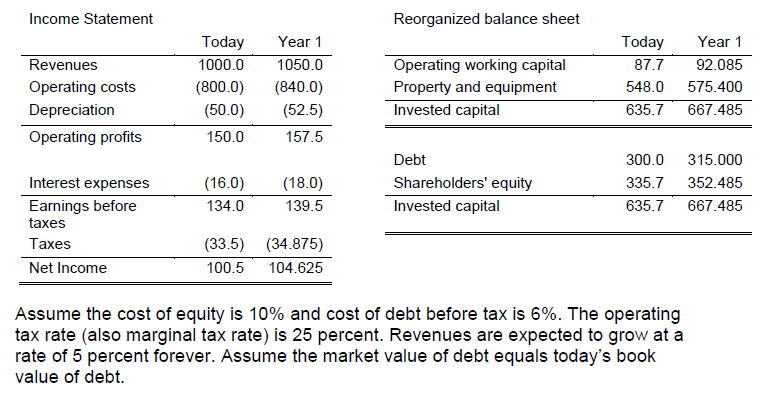

The income statement and reorganized balance sheet for HH Plc. are given below.

Income Statement Reorganized balance sheet Revenues Operating costs Depreciation Operating profits Today 1000.0 (800.0) (50.0) 150.0 Year 1 1050.0 (840.0) (52.5) 157.5 Operating working capital Property and equipment Invested capital Today 87.7 548.0 635.7 Year 1 92.085 575.400 667.485 (16.0) 134.0 (18.0) 139.5 Debt Shareholders' equity Invested capital 300.0 335.7 635.7 315.000 352.485 667.485 Interest expenses Earnings before taxes Taxes Net Income (33.5) (34.875) 100.5 104.625 Assume the cost of equity is 10% and cost of debt before tax is 6%. The operating tax rate (also marginal tax rate) is 25 percent. Revenues are expected to grow at a rate of 5 percent forever. Assume the market value of debt equals today's book value of debt. Income Statement Reorganized balance sheet Revenues Operating costs Depreciation Operating profits Today 1000.0 (800.0) (50.0) 150.0 Year 1 1050.0 (840.0) (52.5) 157.5 Operating working capital Property and equipment Invested capital Today 87.7 548.0 635.7 Year 1 92.085 575.400 667.485 (16.0) 134.0 (18.0) 139.5 Debt Shareholders' equity Invested capital 300.0 335.7 635.7 315.000 352.485 667.485 Interest expenses Earnings before taxes Taxes Net Income (33.5) (34.875) 100.5 104.625 Assume the cost of equity is 10% and cost of debt before tax is 6%. The operating tax rate (also marginal tax rate) is 25 percent. Revenues are expected to grow at a rate of 5 percent forever. Assume the market value of debt equals today's book value of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts