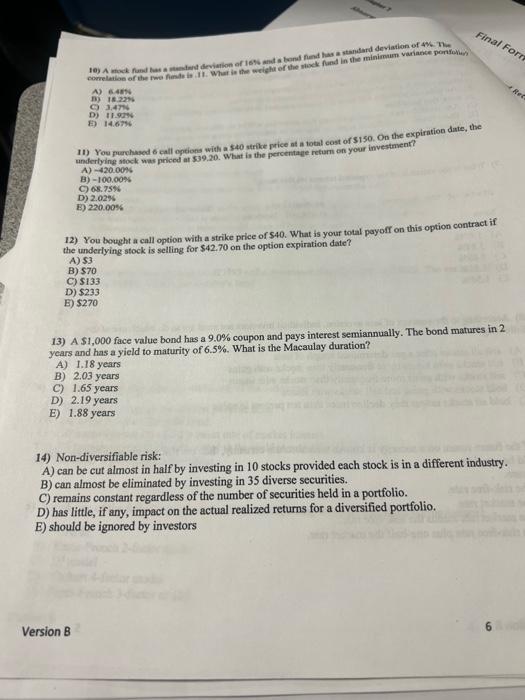

Question: (d) Eusts ii) is.20% c) 3,474. E) 14.67% 11) You gurchased 6 call options with a 540 strike price at a total cost of 3150

(d) Eusts ii) is.20\% c) 3,474. E) 14.67\% 11) You gurchased 6 call options with a 540 strike price at a total cost of 3150 . On the expiration date, the underbying stock was priced at 539.20. What is the percentage return on your investment? A) 420.00B B) 100.00% C) 05.75% D) 2.02% B) 220.00% 12) You bought a call option with a strike price of $40. What is your total payoff on this option contract if the underlying stock is selling for $42.70 on the option expiration date? A) 53 B) 570 C) $133 D) $233 E) 5270 13) A $1,000 face value bond has a 9.0% coupon and pays interest semiannually. The bond matures in 2 years and has a yield to maturity of 6.5%. What is the Macaulay duration? A) 1.18 years B) 2.03 years C) 1.65 years D) 2.19 years E) 1.88 years 14) Non-diversifiable risk: A) can be cut almost in half by investing in 10 stocks provided each stock is in a different industry. B) can almost be eliminated by investing in 35 diverse securities. C) remains constant regardless of the number of securities held in a portfolio. D) has little, if any, impact on the actual realized returns for a diversified portfolio. E) should be ignored by investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts