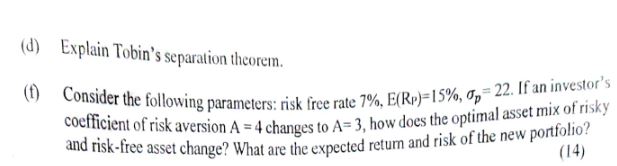

Question: ( d ) Explain Tobin's separation theorem. ( t ) Consider the following parameters: risk free rate 7 % , E ( R p )

d Explain Tobin's separation theorem.

t Consider the following parameters: risk free rate If an investor's

coefficient of risk aversion changes to how does the optimal asset mix of risky

and riskfree asset change? What are the expected retum and risk of the new porfolio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock