Question: ] D file:///Users/munaal-saidi/Library/Mobile%20Documents/com-apple-Preview/Documents/tro https://bbhostad.cuny.aduwebapps/blackboard/ 123.png 2,880x1800 pixels free HW5 - 2020 Fall Tarm (1) Sacurity Analysis FINC Cat Homework Help With Chagg Study Cheg. Submit

![] D file:///Users/munaal-saidi/Library/Mobile%20Documents/com-apple-Preview/Documents/tro https://bbhostad.cuny.aduwebapps/blackboard/ 123.png 2,880x1800 pixels free HW5 - 2020 Fall](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6713f6e475e4c_6356713f6e3c5c8c.jpg) ]

]

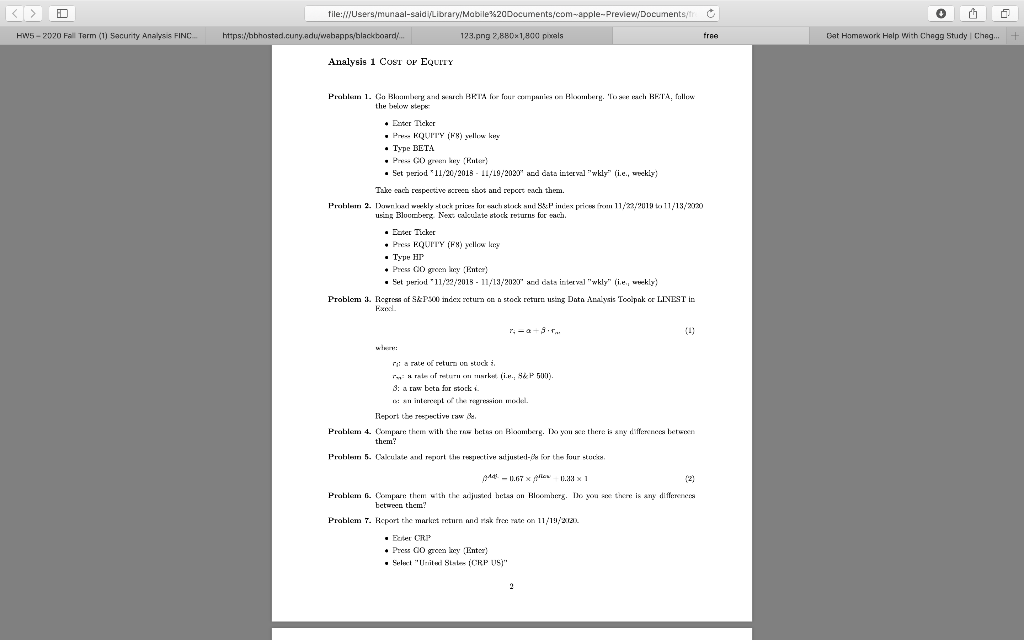

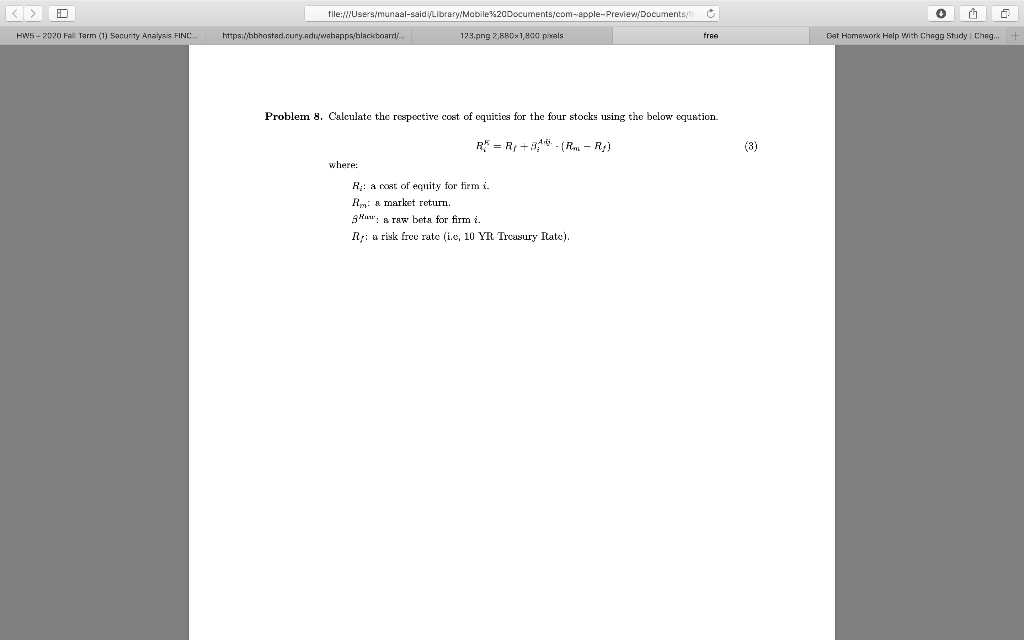

D file:///Users/munaal-saidi/Library/Mobile%20Documents/com-apple-Preview/Documents/tro https://bbhostad.cuny.aduwebapps/blackboard/ 123.png 2,880x1800 pixels free HW5 - 2020 Fall Tarm (1) Sacurity Analysis FINC Cat Homework Help With Chagg Study Cheg. Submit your project in a single EXCEL file. You have to write up with your own words on Excel. Do not copy from others' work. You should show all your references for your project on the last sheet in your Excel. Also, you need to provide all the names (except your team members) you discussed on the last spread sheet well. Instruction: The weighted average cost of capital (WACC) is one of the key inputs in discounted cash flow (DCF) analysis and is frequently the topic of technical investment banking/hedge funds interviews. The WACC is the rate at which a companys future cash flows need to be discounted to arrive at a present value for the business. It reflects the perceived riskiness of the cash flows. Put simply, if the value of a company equals the present value of its future cash flows, WACC is the rate we use to discount those future cash flows to the present. WACC allows you to better assess a company's financial health, both for internal use (in capital budgeting) and external use (valuing companies on investment markets). You have learned how to estimate a company's WACC from the lecture following the standard method. The purpose of this projects is to calculate a firm's WACC based on the Bloomberg approach using the firm's financial data. Even if many investment banks and security analysis firms have their own method, their approaches are fundamentally similar to the Bloomberg method. Thus, figuring out the Bloomberg method would be good practice. For this project, let us calculate the respective WACCs for the following companies. Boeing (BA) NVIDIA (NVDA) . United Airlines Holdings Inc (UAL) Apple (AAPL) i file://Users/munaal-saidi/Library/Mabile%20Documents/com-apple-Preview/Documents/tr HW5 - 2020 Fall Tarm (1) Security Analysis FINC https://bbhostad.cuny.aduwabapps/blackboard 123.png 2,880x1800 pixels free Cat Homework Help With Chagg Study Cheg... Analysis 1 COST OF EQUITY Problem 1. Co Bkamay such BETA Le Four Hikmag'luxe BETA, allow the browser Date Ticker KQUITY (F) willow key Type BETA PD yvenkey Ruter) Set period '11/20/2013 - 11/19:2020" and data interval "wkly (ie, weekly Taloc cach respective crece shot and report sich them. Pr 2. Downlod wwwkly stock price for couch Pincex price from 11:23:2019. 11/13/272) using Bluebey Nex calculate stock returns for each. Duter Ticker P EQUITY (FA) willow any Type HT Prus geen kry Enter) . Set pericol 11/09/2013 - 11/13/2027 cd data interval "Wkly" (ie, weekly Problemi. Regress of S&P900 index turn on stock return using Data Analysis Toolpak or LINISTI 100 na malo ulur un stuck rural coll HITNU i... 56P 500 8: a row beta for stock i 1x: intro kl. Report the rectives & Problem 4. Cep them with them beton Bamberg. Is you so there is any difference beton them? for ina Probleem 5. Calculate and report reptive sujus for the four stors Add-11.67 x N 8 X 1 12) Problem s. Cep them with the adjusted beta an Blaenerg. Do te is any differentes between them? Problem 7. Report the market return and risk free toon 11:19:22 Et CRP Press Ogromley Enter) Select "Unilal SLL CRP US" 2 file:/Users/munaal-sald/Library/Mobile%20Documents/com-apple-Preview/Documents HW5 - 2020 Fall Tarm (1) Security Analysis FINC https://bbhostad.cuny.edu/webappyblackboard/ 123.png 2,880x1,800 pixels free Dat Homework Help With Chagg Study Chag... Problem 8. Calculate the respective cost of equities for the four stocks using the below equation. R = R} + 343. (Rr- Rj) (3) where: R: a cost of equity for firmi Ry: a market return. Huw: a raw beta for firm i. Ry: a risk free rate (1.0, 10 YR Treasury Rate). D file:///Users/munaal-saidi/Library/Mobile%20Documents/com-apple-Preview/Documents/tro https://bbhostad.cuny.aduwebapps/blackboard/ 123.png 2,880x1800 pixels free HW5 - 2020 Fall Tarm (1) Sacurity Analysis FINC Cat Homework Help With Chagg Study Cheg. Submit your project in a single EXCEL file. You have to write up with your own words on Excel. Do not copy from others' work. You should show all your references for your project on the last sheet in your Excel. Also, you need to provide all the names (except your team members) you discussed on the last spread sheet well. Instruction: The weighted average cost of capital (WACC) is one of the key inputs in discounted cash flow (DCF) analysis and is frequently the topic of technical investment banking/hedge funds interviews. The WACC is the rate at which a companys future cash flows need to be discounted to arrive at a present value for the business. It reflects the perceived riskiness of the cash flows. Put simply, if the value of a company equals the present value of its future cash flows, WACC is the rate we use to discount those future cash flows to the present. WACC allows you to better assess a company's financial health, both for internal use (in capital budgeting) and external use (valuing companies on investment markets). You have learned how to estimate a company's WACC from the lecture following the standard method. The purpose of this projects is to calculate a firm's WACC based on the Bloomberg approach using the firm's financial data. Even if many investment banks and security analysis firms have their own method, their approaches are fundamentally similar to the Bloomberg method. Thus, figuring out the Bloomberg method would be good practice. For this project, let us calculate the respective WACCs for the following companies. Boeing (BA) NVIDIA (NVDA) . United Airlines Holdings Inc (UAL) Apple (AAPL) i file://Users/munaal-saidi/Library/Mabile%20Documents/com-apple-Preview/Documents/tr HW5 - 2020 Fall Tarm (1) Security Analysis FINC https://bbhostad.cuny.aduwabapps/blackboard 123.png 2,880x1800 pixels free Cat Homework Help With Chagg Study Cheg... Analysis 1 COST OF EQUITY Problem 1. Co Bkamay such BETA Le Four Hikmag'luxe BETA, allow the browser Date Ticker KQUITY (F) willow key Type BETA PD yvenkey Ruter) Set period '11/20/2013 - 11/19:2020" and data interval "wkly (ie, weekly Taloc cach respective crece shot and report sich them. Pr 2. Downlod wwwkly stock price for couch Pincex price from 11:23:2019. 11/13/272) using Bluebey Nex calculate stock returns for each. Duter Ticker P EQUITY (FA) willow any Type HT Prus geen kry Enter) . Set pericol 11/09/2013 - 11/13/2027 cd data interval "Wkly" (ie, weekly Problemi. Regress of S&P900 index turn on stock return using Data Analysis Toolpak or LINISTI 100 na malo ulur un stuck rural coll HITNU i... 56P 500 8: a row beta for stock i 1x: intro kl. Report the rectives & Problem 4. Cep them with them beton Bamberg. Is you so there is any difference beton them? for ina Probleem 5. Calculate and report reptive sujus for the four stors Add-11.67 x N 8 X 1 12) Problem s. Cep them with the adjusted beta an Blaenerg. Do te is any differentes between them? Problem 7. Report the market return and risk free toon 11:19:22 Et CRP Press Ogromley Enter) Select "Unilal SLL CRP US" 2 file:/Users/munaal-sald/Library/Mobile%20Documents/com-apple-Preview/Documents HW5 - 2020 Fall Tarm (1) Security Analysis FINC https://bbhostad.cuny.edu/webappyblackboard/ 123.png 2,880x1,800 pixels free Dat Homework Help With Chagg Study Chag... Problem 8. Calculate the respective cost of equities for the four stocks using the below equation. R = R} + 343. (Rr- Rj) (3) where: R: a cost of equity for firmi Ry: a market return. Huw: a raw beta for firm i. Ry: a risk free rate (1.0, 10 YR Treasury Rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts