Question: D. Financial Statement Analysis (Chapter 3) 1. Construct a Common Size Income Statement for your company last period 2. Construct a Common Size Income Statement

D. Financial Statement Analysis (Chapter 3)

1. Construct a Common Size Income Statement for your company last period

2. Construct a Common Size Income Statement for your company for the prior period

3. Evaluate which costs have risen and which have fallen by comparing D.1 and D.2

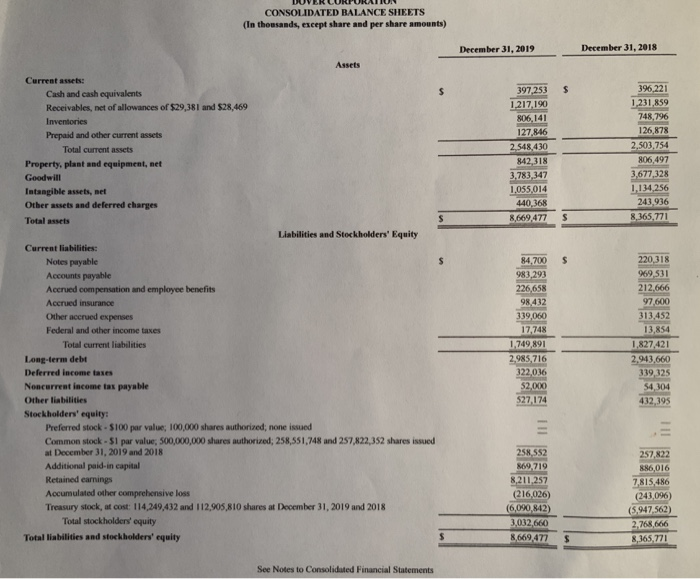

4. Construct a Common Size Balance Sheet for your company.

5. Compare the ROE for your company this year compared to last year (and determine if performance has improved)

OVER CORPORATION CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 31, 2019 December 31, 2018 397,253 1.217.190 806.141 127 846 396,221 1,231,859 748,796 126,878 2.548.430 2.503.754 842 318 3.783,347 1.055.014 440.368 806,497 3,677,328 1,134,256 243.936 8,365,771 8,669,477 Assets Current asses: Cash and cash equivalents Receivables, net of allowances of $29,381 and $28,469 Inventories Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other assets and deferred charges Total assets Liabilities and Stockholders' Equity Current liabilities: Notes payable Accounts payable Accrued compensation and employee benefits Accrued insurance Other accrued expenses Federal and other income taxes Total current liabilities Long-term debt Deferred income taxes Noncurrent income tax payable Other liabilities Stockholders' equity: Preferred stock - $100 par value; 100,000 shares authorized: none issued Common stock - 51 par value, 500,000,000 shares authorized; 258,551,748 and 257,822,352 shares issued at December 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 114,249,432 and 112,905,810 shares at December 31, 2019 and 2018 Total stockholders' equity Total liabilities and stockholders' equity 84,700 983,293 226,658 98432 339,060 17.748 220,318 969.531 212,666 97,600 313,452 13,854 1.749,891 1.827,421 2,985,716 322,036 52,000 527.174 2,943.660 339,325 54. 104 432,393 258.552 869,719 8.211.257 (216,026) (6,020,842) 3.032.660 257,822 886,016 7,815,486 (243,096) (5.947.562) 2.768.666 2012 AT 8.669.477 $ 8.365,771 See Notes to Consolidated Financial Statements OVER CORPORATION CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 31, 2019 December 31, 2018 397,253 1.217.190 806.141 127 846 396,221 1,231,859 748,796 126,878 2.548.430 2.503.754 842 318 3.783,347 1.055.014 440.368 806,497 3,677,328 1,134,256 243.936 8,365,771 8,669,477 Assets Current asses: Cash and cash equivalents Receivables, net of allowances of $29,381 and $28,469 Inventories Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other assets and deferred charges Total assets Liabilities and Stockholders' Equity Current liabilities: Notes payable Accounts payable Accrued compensation and employee benefits Accrued insurance Other accrued expenses Federal and other income taxes Total current liabilities Long-term debt Deferred income taxes Noncurrent income tax payable Other liabilities Stockholders' equity: Preferred stock - $100 par value; 100,000 shares authorized: none issued Common stock - 51 par value, 500,000,000 shares authorized; 258,551,748 and 257,822,352 shares issued at December 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 114,249,432 and 112,905,810 shares at December 31, 2019 and 2018 Total stockholders' equity Total liabilities and stockholders' equity 84,700 983,293 226,658 98432 339,060 17.748 220,318 969.531 212,666 97,600 313,452 13,854 1.749,891 1.827,421 2,985,716 322,036 52,000 527.174 2,943.660 339,325 54. 104 432,393 258.552 869,719 8.211.257 (216,026) (6,020,842) 3.032.660 257,822 886,016 7,815,486 (243,096) (5.947.562) 2.768.666 2012 AT 8.669.477 $ 8.365,771 See Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts