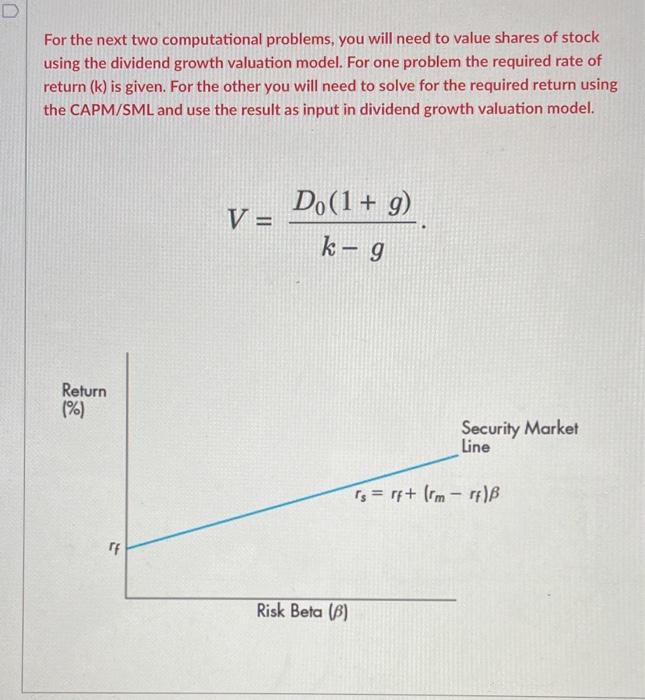

Question: D For the next two computational problems, you will need to value shares of stock using the dividend growth valuation model. For one problem the

D For the next two computational problems, you will need to value shares of stock using the dividend growth valuation model. For one problem the required rate of return (k) is given. For the other you will need to solve for the required return using the CAPM/SML and use the result as input in dividend growth valuation model. D.(1+ g) V = k- g Return (%) Security Market Line Is = rf+ (rm - FB FF Risk Beta (6) Question 17 5 pts You are analyzing shares of company GHI. It is currently paying a $7.50 dividend, and you expect that to grow at 1% annually. The stock is trading at $60. nar.share and your rauired rate of return is 14%. Based upon your valuation, you should consid V [ Select] - stock GHI. going long going short D Question 17 5 pts You are analyzing shares of company GHI. It is currently paying a $7.50 dividend, and you expect that to grow at 1% annually. The stock is trading at $60 per share and your required rate of return is 14%. Based upon your valuation, you should consider (Select) stock GHI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts