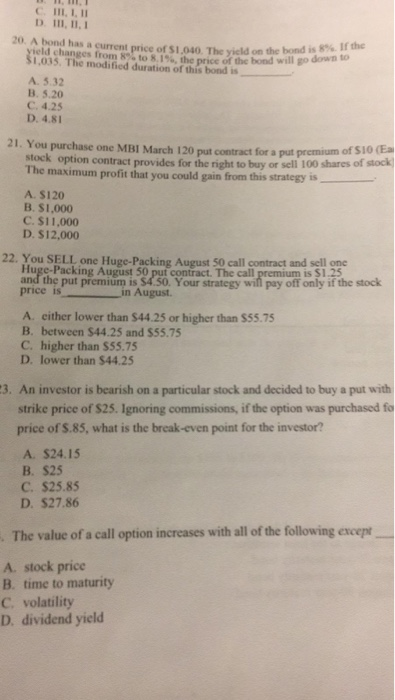

Question: D. I11, 11, 1 20. A bond has a eldchanges frorn 8% 1,035. The modified duration of this bond is rn-price of$1,040 The yield on

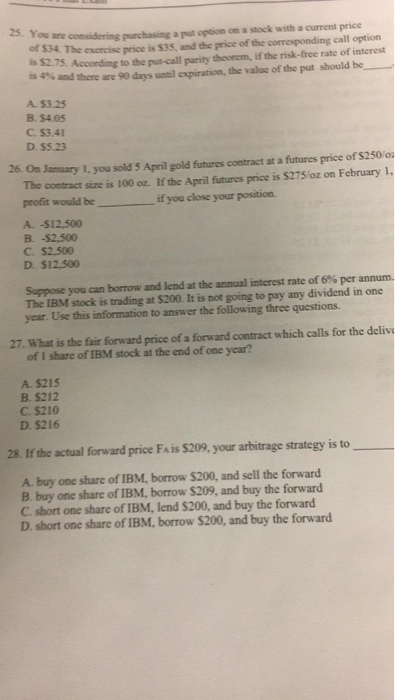

D. I11, 11, 1 20. A bond has a eldchanges frorn 8% 1,035. The modified duration of this bond is rn-price of$1,040 The yield on the bond is 8% to the ed duration of t f the bond will go downto A. 5.32 B. 5.20 C. 4.25 D. 4.81 21. You purchase one MBI March 120 put contract for a put premium of S10 (Ea option contract provides for the right to buy or sell 100 shares of stock The maximum profit that you could gain from this strategy is A. $120 B. $1,000 C. $11,000 D. $12,000 Huge-Packing August 50 put contract. The call is $1.25 the put pemium is So Your srategy w price is_ in August. py off only if the sck A. either lower than $44.25 or higher than $55.75 B. between $44.25 and $55.75 C. higher than $55.75 D. lower than $44.25 3. An investor is bearish on a particular stock and decided to buy a put with strike price of $25. Ignoring commissions, if the option was purchased fo price of $.85, what is the break-even point for the investor? A. $24.15 B. $25 C. S25.85 D. $27.86 The value of a call option increases with all of the following except A. stock price B. time to maturity C, volatility D. dividend yield 25. You or s34. The exercise price is 535, and the price of the corresponding call option Is $2.75. According to the put-call parity theorem, if the risk-free rate of interest 84% and there are 90 days until expiration, the value ofthe put should be . A $3.25 B. $4.05 C. $3.41 D. $5.23 26 On January 1, you sold S April gold futures contract at a futures price of S250/o The contract size is 100 oz. If the April futures price is $275/oz on February 1 Protit would beif you close your position A -$12,500 B -$2,500 C. $2.500 D. $12.500 xppose you can borrow and lend at the annual interest rate of6% per annum. The IBM stock is trading at $200. It is not going to pay any dividend in one year. Use this information to answer the following three questions. 27. What is the fair forward price of a forward contract which calls for the deliv of I share of IBM stock at the end of one year? A. $215 B. $212 C. $210 D. $216 28. If the actual forward price FAis $209, your arbitrage strategy is to A. buy one share of IBM, borrow $200, and sell the forward B. buy one share of IBM, borrow $209, and buy the forward C. short one share of IBM, lend $200, and buy the forward D. short one share of IBM, borrow $200, and buy the forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts