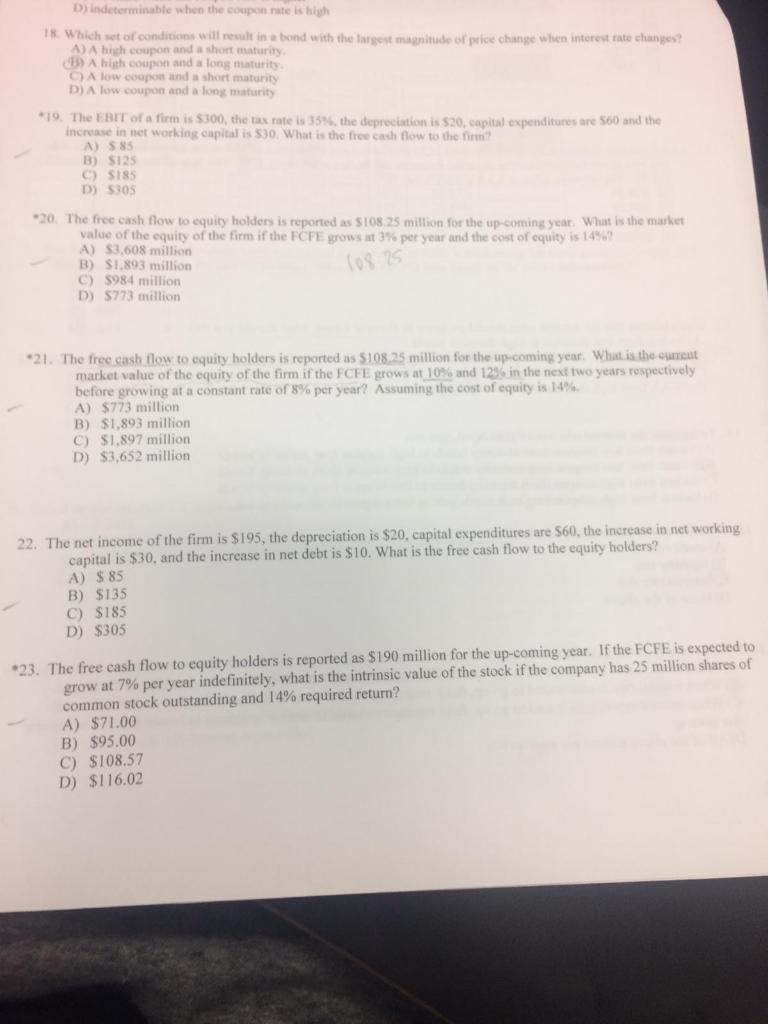

Question: D) indeterminable when the coupon it is high 18. Which set of conditions will result in a bond with the largest magnitude of price change

D) indeterminable when the coupon it is high 18. Which set of conditions will result in a bond with the largest magnitude of price change when interest rate changes? A) A hit coupon and a short maturity DA hit coupon and a long maturity C) A low coupon and a short maturity D) A low coupon and a long maturity *19. The EBIT of a firm is $300, the tax rate is 15% the depreciation is $20, capital expenditures are 560 and the increase in net working capital is 530. What is the free cash flow to the firm A) 585 B) $123 C) S185 D) $305 20. The free cash flow to equity holders is reported as STO8.25 million for the upcoming year. What is the market value of the equity of the firm if the FCFE grows at 3% per year and the cost of equity is 14967 A) 53,608 million B) S1.893 million C) $984 million D) $773 million 10825 21. The free cash flow to equity holders is reported as $108,25 million for the upcoming year. What is the current market value of the equity of the firm if the FCFE grows at 10% and 1296 in the next two years respectively before growing at a constant rate of 8% per year? Assuming the cost of equity is 14% A) $773 million B) $1,893 million C) $1,897 million D) $3,652 million 22. The net income of the firm is $195, the depreciation is $20, capital expenditures are 560, the increase in net working capital is $30, and the increase in net debt is $10. What is the free cash flow to the equity holders? A) $ 85 B) $135 C) $185 D) $305 *23. The free cash flow to equity holders is reported as $190 million for the up-coming year. If the FCFE is expected to grow at 7% per year indefinitely, what is the intrinsic value of the stock if the company has 25 million shares of common stock outstanding and 14% required return? A) $71.00 B) $95.00 C) $108.57 D) $116.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts