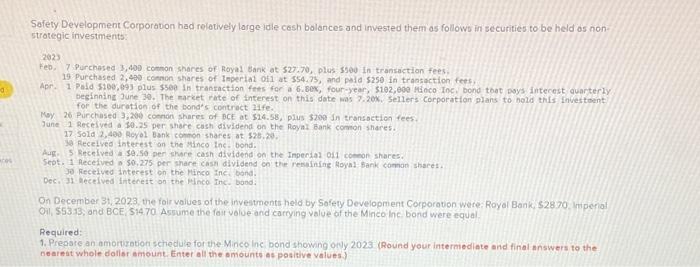

Question: d K ces Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as non- strategic

Safety Development Corporation had relatively large idle cesh bolances and invested them os follows in securities to be held os nonstrotegic investments: 2023 Feb, 7 Purchased 3,400 comon shares of Royal 8 ank at 527.70 , plus 5900 in transaction fees. 19 Purchased 2,430 cesoon shares of loperiat of 1 at \\( \\$ 54.73 \\), and pala \\( \\$ 250 \\) in transaction fees. beginning June 39. The market pate of interest on this dote was 7.200 . Sellers Corporation plans to hold this investoent for the duration of the bond's contract \\( 21 \\mathrm{fe} \\). Msy 26 Purchused 3 , 200 coenon shares of BCE at 314.58 , plus 3209 in sransoction fees. June 1 Recelved a 30.25 per share cash dividehd on the Royal Bank comon shares. 39 Recelved interest on the Hinco inc. bond. Aug. 5 Recelved a se.so per shore cash dividend on the Impendal ofl coenon shares. Sept. 1 llecefved o 50,275 per share casn dividend on the resuining Heyal- Bank comon shares. 90 . Fiecelved interest on the Pinco inc, bond. Dec. 31 - becelved interelt on the isince inc. bood. On December 31,2023, the foir values of the investments held by Sofery Development Corporavon were: Royal Bank, 528.70 . Imperial Cil, 55313, and BCE, 51470 Assume the far volue and carrying value of the Mincolinc. bond were equal. Required: 1. Prepsic an amorturation schedule for the Mince inc bond showng orly 2023 (Round your intermediate and final answers to the noareat whole doller amount. Enter all the smounts as positive values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts