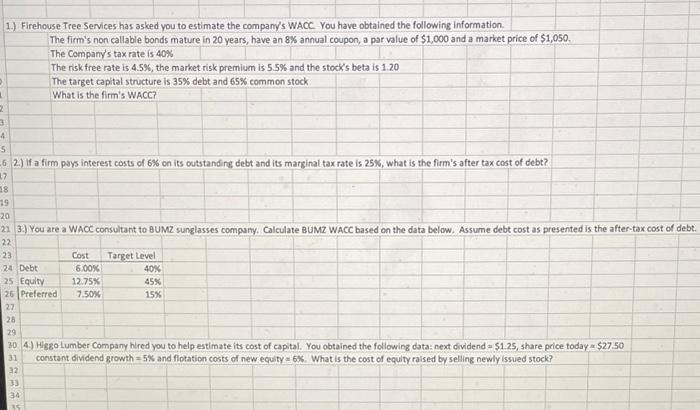

Question: D L 2 1.) Firehouse Tree Services has asked you to estimate the company's WACC. You have obtained the following information. The firm's non

D L 2 1.) Firehouse Tree Services has asked you to estimate the company's WACC. You have obtained the following information. The firm's non callable bonds mature in 20 years, have an 8% annual coupon, a par value of $1,000 and a market price of $1,050. The Company's tax rate is 40% The risk free rate is 4.5%, the market risk premium is 5.5% and the stock's beta is 1.20 3 4 5 6 2.) If a firm pays interest costs of 6% on its outstanding debt and its marginal tax rate is 25%, what is the firm's after tax cost of debt? 17 18 19 20 21 3.) You are a WACC consultant to BUMZ sunglasses company. Calculate BUMZ WACC based on the data below. Assume debt cost as presented is the after-tax cost of debt. 22 23 24 Debt 25 Equity 26 27 BRAREERS: 28 29 32 The target capital structure is 35% debt and 65% common stock What is the firm's WACC? Preferred 33 34 30 4.) Higgo Lumber Company hired you to help estimate its cost of capital. You obtained the following data: next dividend - $1.25, share price today - $27.50 constant dividend growth = 5% and flotation costs of new equity-6%. What is the cost of equity raised by selling newly issued stock? 31 35 Cost 6.00% 12.75% 7.50% Target Level 40% 45% 15%

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

1 Firehouse Tree Service WACC as follows Cost of equity4512055 045066 111 or 111 WA... View full answer

Get step-by-step solutions from verified subject matter experts