Question: (d) Micro-Technology will need to borrow 10 million for a 3-month period, starting in 3 months' time and has in place an agreement with a

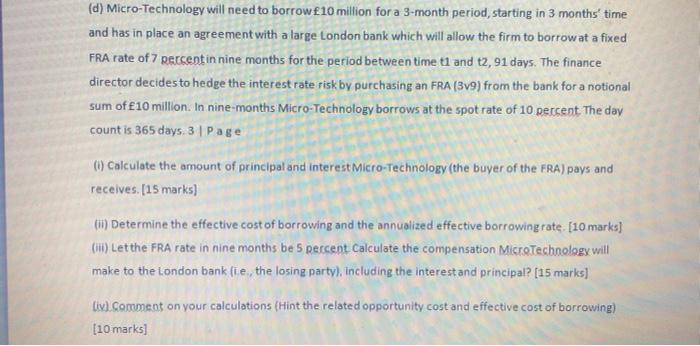

(d) Micro-Technology will need to borrow 10 million for a 3-month period, starting in 3 months' time and has in place an agreement with a large London bank which will allow the firm to borrow at a fixed FRA rate of 7 Raccent in nine months for the period between time t1 and 12,91 days. The finance director decides to hedge the interest rate risk by purchasing an FRA (3v9) from the bank for a notional sum of 10 million. In nine months Micro-Technology borrows at the spot rate of 10 percent. The day count is 365 days, 31 Page (1) Calculate the amount of principal and interest Micro-Technology (the buyer of the FRA) pays and receives. [15 marks) ) Determine the effective cost of borrowing and the annualized effective borrowing rate [10 marks] (1) Let the FRA rate in nine months be 5 percent Calculate the compensation MicroTechnology will make to the London bank (ie, the losing party), including the interest and principal? [15 marks) til. Comment on your calculations (Hint the related opportunity cost and effective cost of borrowing) (10 marks] (d) Micro-Technology will need to borrow 10 million for a 3-month period, starting in 3 months' time and has in place an agreement with a large London bank which will allow the firm to borrow at a fixed FRA rate of 7 Raccent in nine months for the period between time t1 and 12,91 days. The finance director decides to hedge the interest rate risk by purchasing an FRA (3v9) from the bank for a notional sum of 10 million. In nine months Micro-Technology borrows at the spot rate of 10 percent. The day count is 365 days, 31 Page (1) Calculate the amount of principal and interest Micro-Technology (the buyer of the FRA) pays and receives. [15 marks) ) Determine the effective cost of borrowing and the annualized effective borrowing rate [10 marks] (1) Let the FRA rate in nine months be 5 percent Calculate the compensation MicroTechnology will make to the London bank (ie, the losing party), including the interest and principal? [15 marks) til. Comment on your calculations (Hint the related opportunity cost and effective cost of borrowing) (10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts