D. Prepare the consolidation worksheet journal entries to eliminate the effects of inter-entity transactions as at 30

Fantastic news! We've Found the answer you've been seeking!

Question:

D. Prepare the consolidation worksheet journal entries to eliminate the effects of inter-entity transactions as at 30 June 2017.

D. Prepare the consolidation worksheet journal entries to eliminate the effects of inter-entity transactions as at 30 June 2017.

Transcribed Image Text:

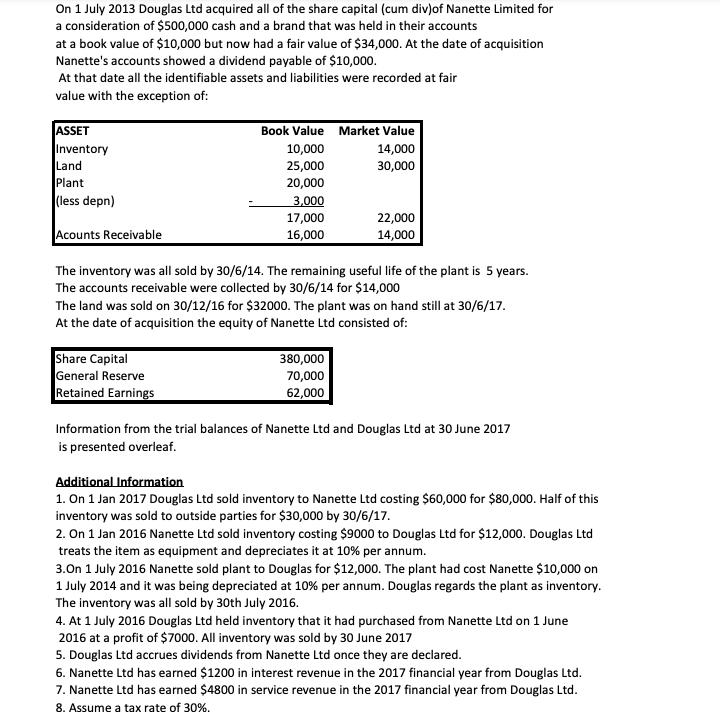

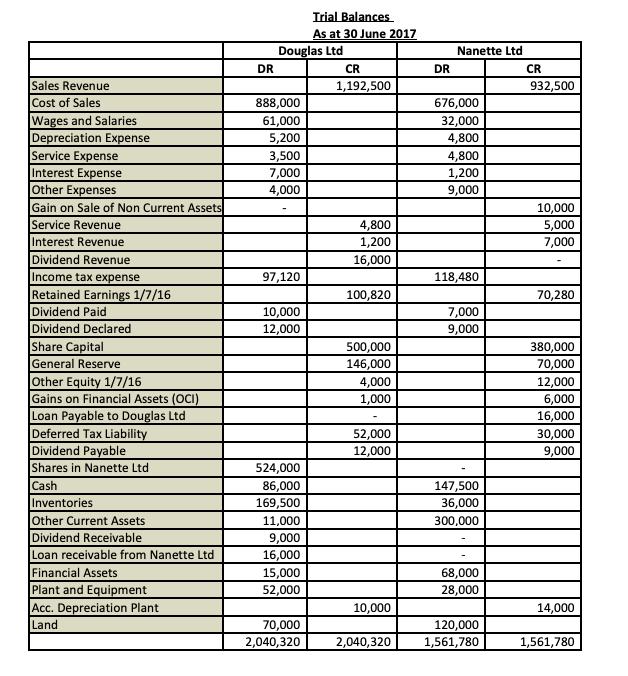

On 1 July 2013 Douglas Ltd acquired all of the share capital (cum div)of Nanette Limited for a consideration of $500,000 cash and a brand that was held in their accounts at a book value of $10,000 but now had a fair value of $34,000. At the date of acquisition Nanette's accounts showed a dividend payable of $10,000. At that date all the identifiable assets and liabilities were recorded at fair value with the exception of: ASSET Inventory Land Plant (less depn) Acounts Receivable Book Value 10,000 25,000 20,000 3,000 17,000 16,000 Share Capital General Reserve Retained Earnings Market Value 14,000 30,000 The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $14,000 22,000 14,000 The land was sold on 30/12/16 for $32000. The plant was on hand still at 30/6/17. At the date of acquisition the equity of Nanette Ltd consisted of: 380,000 70,000 62,000 Information from the trial balances of Nanette Ltd and Douglas Ltd at 30 June 2017 is presented overleaf. Additional Information 1. On 1 Jan 2017 Douglas Ltd sold inventory to Nanette Ltd costing $60,000 for $80,000. Half of this inventory was sold to outside parties for $30,000 by 30/6/17. 2. On 1 Jan 2016 Nanette Ltd sold inventory costing $9000 to Douglas Ltd for $12,000. Douglas Ltd treats the item as equipment and depreciates it at 10% per annum. 3.On 1 July 2016 Nanette sold plant to Douglas for $12,000. The plant had cost Nanette $10,000 on 1 July 2014 and it was being depreciated at 10% per annum. Douglas regards the plant as inventory. The inventory was all sold by 30th July 2016. 4. At 1 July 2016 Douglas Ltd held inventory that it had purchased from Nanette Ltd on 1 June 2016 at a profit of $7000. All inventory was sold by 30 June 2017 5. Douglas Ltd accrues dividends from Nanette Ltd once they are declared. 6. Nanette Ltd has earned $1200 in interest revenue in the 2017 financial year from Douglas Ltd. 7. Nanette Ltd has earned $4800 in service revenue in the 2017 financial year from Douglas Ltd. 8. Assume a tax rate of 30%. On 1 July 2013 Douglas Ltd acquired all of the share capital (cum div)of Nanette Limited for a consideration of $500,000 cash and a brand that was held in their accounts at a book value of $10,000 but now had a fair value of $34,000. At the date of acquisition Nanette's accounts showed a dividend payable of $10,000. At that date all the identifiable assets and liabilities were recorded at fair value with the exception of: ASSET Inventory Land Plant (less depn) Acounts Receivable Book Value 10,000 25,000 20,000 3,000 17,000 16,000 Share Capital General Reserve Retained Earnings Market Value 14,000 30,000 The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $14,000 22,000 14,000 The land was sold on 30/12/16 for $32000. The plant was on hand still at 30/6/17. At the date of acquisition the equity of Nanette Ltd consisted of: 380,000 70,000 62,000 Information from the trial balances of Nanette Ltd and Douglas Ltd at 30 June 2017 is presented overleaf. Additional Information 1. On 1 Jan 2017 Douglas Ltd sold inventory to Nanette Ltd costing $60,000 for $80,000. Half of this inventory was sold to outside parties for $30,000 by 30/6/17. 2. On 1 Jan 2016 Nanette Ltd sold inventory costing $9000 to Douglas Ltd for $12,000. Douglas Ltd treats the item as equipment and depreciates it at 10% per annum. 3.On 1 July 2016 Nanette sold plant to Douglas for $12,000. The plant had cost Nanette $10,000 on 1 July 2014 and it was being depreciated at 10% per annum. Douglas regards the plant as inventory. The inventory was all sold by 30th July 2016. 4. At 1 July 2016 Douglas Ltd held inventory that it had purchased from Nanette Ltd on 1 June 2016 at a profit of $7000. All inventory was sold by 30 June 2017 5. Douglas Ltd accrues dividends from Nanette Ltd once they are declared. 6. Nanette Ltd has earned $1200 in interest revenue in the 2017 financial year from Douglas Ltd. 7. Nanette Ltd has earned $4800 in service revenue in the 2017 financial year from Douglas Ltd. 8. Assume a tax rate of 30%.

Expert Answer:

Answer rating: 100% (QA)

Elimination Entries To eliminate the effects of interentity transactions as at 30 June 2017 the following journal entries need to be made 1 To elimina... View the full answer

Related Book For

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville

Posted Date:

Students also viewed these accounting questions

-

Prepare the consolidation worksheet as at 30 June 2020, showing all entries including the corrected entries discussed. Round your answers to zero decimal places. Sales revenue Cost of sales Gross...

-

The trial balance for Eureka Ltd as at 30 June 2012 (before calculation of income tax) is as follows: Note: this is the first year of operation of Eureka Ltd. DR CR $000 $000 Sales Revenue 1235 Cost...

-

Comparative information as at 30 June 2017 and 30 June 2018 for Pretentious Ltd is as follows: pretentious LTD Comparative Statements of Financial Position as at 30 June 2017 2018 ASSETS Cash at bank...

-

What are the Four Eras of Commercial Aviation Safety in order from the 1950's to the future?

-

The income statement and additional data of Floral World Ltd. follow: Additional data: a. Collections from customers are $30,000 more than sales. b. Payments to suppliers are $1,000 more than the sum...

-

Why is the basic earning power ratio useful? AppendixLO1

-

What your equity investors IRR would be based on the percentage of ownership you are planning to offer him, how much he is investing, and the cash flow you are projecting.

-

On January 1, 2010, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid of 52,000,000 British pounds (£), which was equal to...

-

This semester we discussed several ways in which a company that is under pressure to meet expectations can manipulate its net income. Assume the Kool G Rap ( KGR ) Company is expected by analysts and...

-

Cell Therapy, Inc. has a cost of capital of 9%, and it has a project with the following cash flows. What is the NPV of this project? Year Net Cash Flow Cell Therapy, Inc. Cash Flows 0 -100,000 1...

-

(a) Convert r= 4sin6' into a circle equation. Hence, identify its centre and radius

-

Ted sold his Microsoft stock for $40,000 paying a commission of $800. He purchased the stock in 2004 for $8,000 and paid commission of $200. What is the recognized gain on the sale?

-

Liquid water at 80C and at 1atm flows through a heated pipe at a flow rate of 3.1 kg/s. It then leaves the pipe as steam. The water receives 9753840 J of heating from the pipe. Calculate the...

-

The balance sheet of River Electronics Corporation as of December 31, 2023, included 14.00% bonds having a face amount of $90.7 million. The bonds had been issued in 2016 and had a remaining discount...

-

The term mutually exclusive means that two events have no common elements in them. The occurrence of one event means that the other other event does not occur. An example of a mutually exclusive...

-

9a A conical pendulum is made by hanging a mass of 5.0 kg from a large spring of length 1.0 m and spring constant k = 100 N/m. The spring moves in a circle at an angle of 25 deg. When at rest hanging...

-

find 1-5 Adjusted Trial Balance Cash Accounts receivable Supplies Prepaid Insurance Property, Plant & Equipment Accumulated depreciation Accounts payable Salaries payable Utilities payable Deferred...

-

To help you become familiar with the accounting standards, this case is designed to take you to the FASBs Web site and have you access various publications. Access the FASBs Web site at...

-

Kenston Ltd prepares financial statements to 30 April each year. At 30 April 2018, the company is being sued by a customer who claims to have been harmed by one of the company's products. The case...

-

Petersford plc prepares accounts to 31 December each year. On 1 January 2014, the company acquired a non-current asset at a cost of 256,000 and decided to depreciate this asset on the straight-line...

-

E plc has an issued share capital consisting of 800,000 ordinary shares. There are no preference shares. Some years ago, the company issued 1 million of 10% convertible loan stock, convertible in...

-

A third-party logistics provider (3PL) provides outsourced or third-party logistics services to companies for part or all of their distribution activities. Examples include DHL, DB Schenker...

-

Your parent company is supposedly based in Singapore with manufacturing plants in Malaysia. The company sells sterile dressings and other surgical disposal items to hospitals and clinics in over 30...

-

Procter and Gamble (P&G) and Unilever are the two leading firms in the consumer products industry for offerings such as soap, shampoo, and laundry detergent. P&G (www.pg.com) is based in the United...

Study smarter with the SolutionInn App