Question: d. Project A, because it has a higher IRR. e. Indifferent, because the projects have equal IRRs. 13 ad out of You are a Project

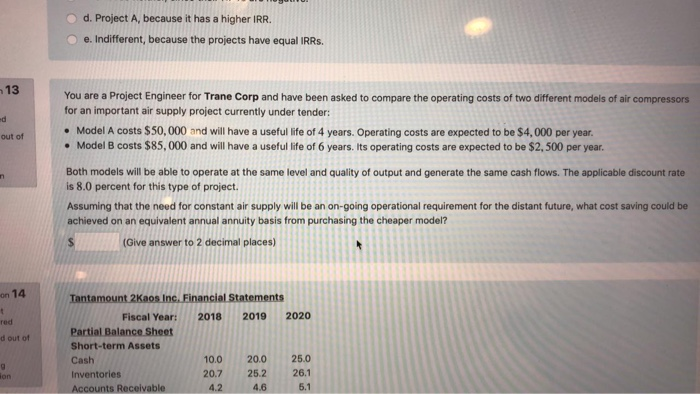

d. Project A, because it has a higher IRR. e. Indifferent, because the projects have equal IRRs. 13 ad out of You are a Project Engineer for Trane Corp and have been asked to compare the operating costs of two different models of air compressors for an important air supply project currently under tender: . Model A costs $50,000 and will have a useful life of 4 years. Operating costs are expected to be $4,000 per year. . Model B costs $85,000 and will have a useful life of 6 years. Its operating costs are expected to be $2,500 per year. Both models will be able to operate at the same level and quality of output and generate the same cash flows. The applicable discount rate is 8.0 percent for this type of project. Assuming that the need for constant air supply will be an on-going operational requirement for the distant future, what cost saving could be achieved on an equivalent annual annuity basis from purchasing the cheaper model? (Give answer to 2 decimal places) n $ von 14 Tantamount 2Kaos Inc. Financial Statements - 2018 2019 2020 red d out of Fiscal Year: Partial Balance Sheet Short-term Assets Cash Inventories Accounts Receivable 10.0 20.7 4.2 son 20.0 25.2 4.6 25.0 26.1 5.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts