Question: D Question 0.5 pts The NRDC has traditionally employed a hom wide discount rate for capital budgeting purposes. However, its two divisions - publishing and

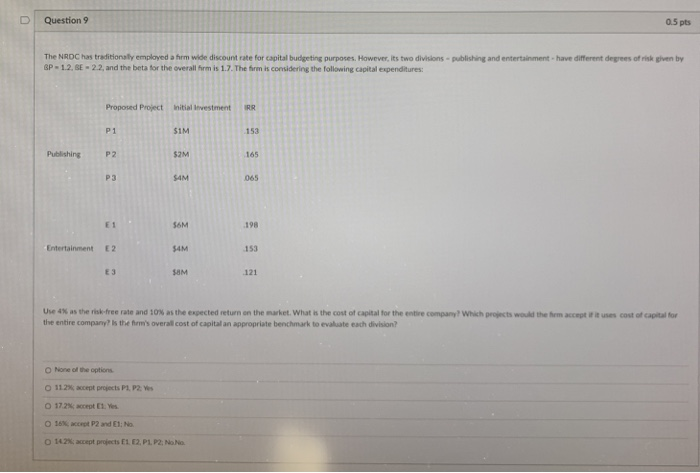

D Question 0.5 pts The NRDC has traditionally employed a hom wide discount rate for capital budgeting purposes. However, its two divisions - publishing and entertainment - have different degrees of risk given by BP-1.2.SE -2.2, and the beta for the overall form is 1.7. The form is considering the following capital expenditures: Proposed Project initiativestment IRR P1 SIM 153 Publishing P2 $2M 165 P3 SAM 065 E1 S6M 198 Entertainment E2 54M 153 E3 SOM 121 Use 4% as the risk free rate and 10% as the expected return on the market. What is the cost of capital for the entire company which projects would the term accept it uses cost of capital for the entire company? Is the firm's overall cost of capital an appropriate benchmark to evaluate each division None of the options 112 accept projects P1, P2: Yes 17.2 et Yes 16. P2 and En 142:accept projects 1.2, P1, P2, No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts