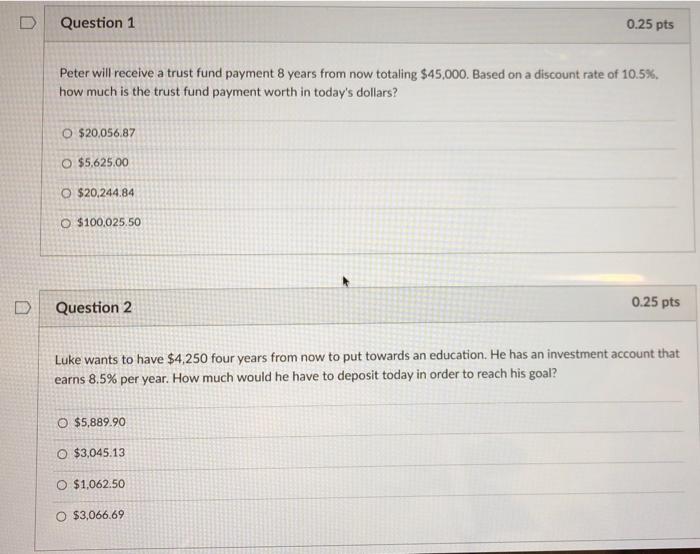

Question: D Question 1 0.25 pts Peter will receive a trust fund payment 8 years from now totaling $45,000. Based on a discount rate of 10.5%,

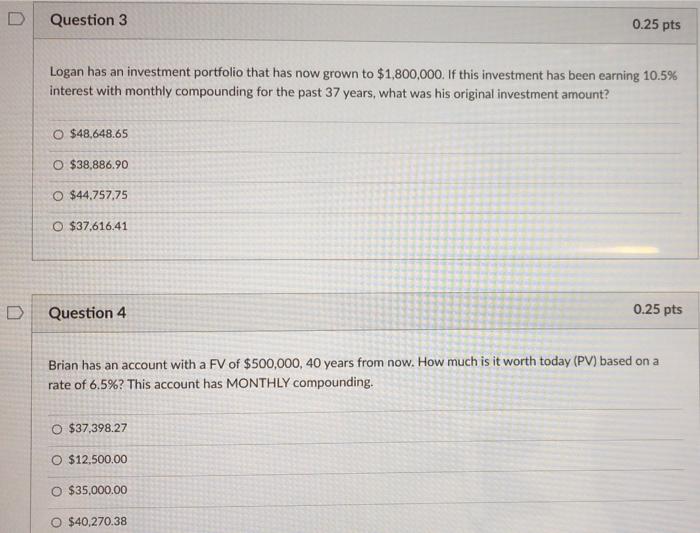

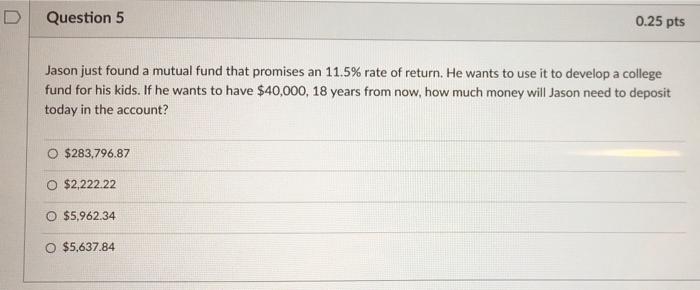

D Question 1 0.25 pts Peter will receive a trust fund payment 8 years from now totaling $45,000. Based on a discount rate of 10.5%, how much is the trust fund payment worth in today's dollars? O $20,056.87 O $5,625.00 $20,244.84 O $100,025.50 D Question 2 0.25 pts Luke wants to have $4,250 four years from now to put towards an education. He has an investment account that earns 8.5% per year. How much would he have to deposit today in order to reach his goal? O $5,889.90 O $3,045.13 O $1,062.50 $3,066,69 D Question 3 0.25 pts Logan has an investment portfolio that has now grown to $1,800,000. If this investment has been earning 10.5% interest with monthly compounding for the past 37 years, what was his original investment amount? O $48,648.65 O $38,886.90 O $44.757.75 0 $37,616.41 Question 4 0.25 pts Brian has an account with a FV of $500,000, 40 years from now. How much is it worth today (PV) based on a rate of 6.5%? This account has MONTHLY compounding. O $37,398.27 O $12,500.00 O $35,000.00 $40,270.38 D Question 5 0.25 pts Jason just found a mutual fund that promises an 11.5% rate of return. He wants to use it to develop a college fund for his kids. If he wants to have $40,000, 18 years from now, how much money will Jason need to deposit today in the account? O $283,796.87 $2,222.22 $5,962.34 $5,637.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts