Question: D Question 1 2 pts SDJ, Inc., has net working capital of $1,559, current liabilities of $6,922, and inventory of $371. What is the current

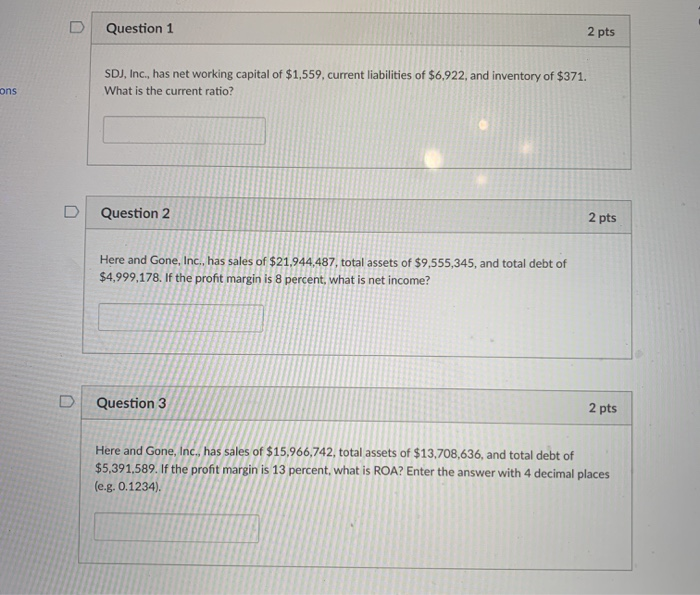

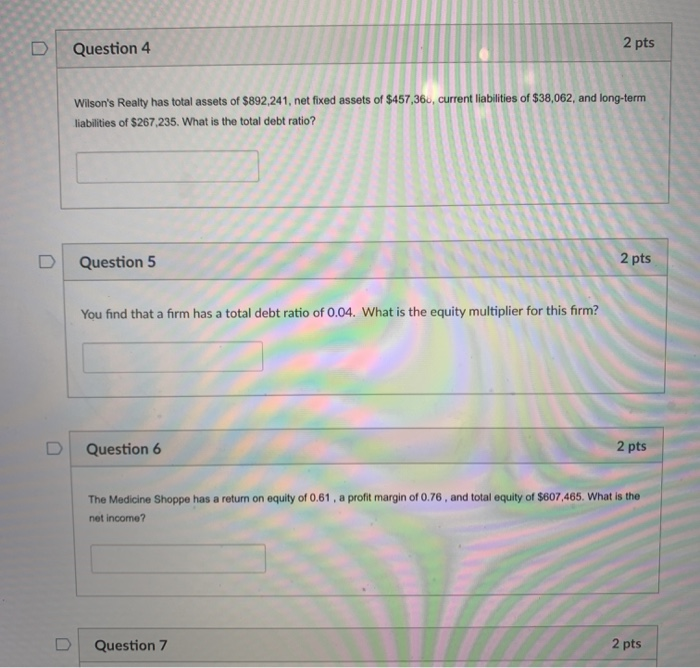

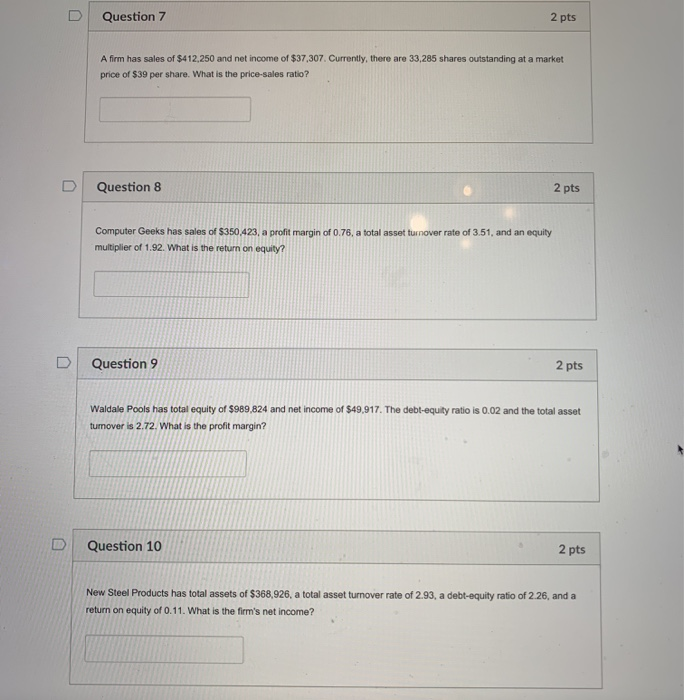

D Question 1 2 pts SDJ, Inc., has net working capital of $1,559, current liabilities of $6,922, and inventory of $371. What is the current ratio? ons D Question 2 2 pts Here and Gone, Inc., has sales of $21,944,487, total assets of $9,555,345, and total debt of $4,999,178. If the profit margin is 8 percent, what is net income? Question 3 2 pts Here and Gone, Inc., has sales of $15,966,742, total assets of $13,708,636, and total debt of $5,391,589. If the profit margin is 13 percent, what is ROA? Enter the answer with 4 decimal places (e.g. 0.1234). Question 4 2 pts Wilson's Realty has total assets of $892,241, net fixed assets of $457,36, current liabilities of $38,062, and long-term liabilities of $267.235. What is the total debt ratio? Question 5 2 pts You find that a firm has a total debt ratio of 0.04. What is the equity multiplier for this form? Question 6 2 pts The Medicine Shoppe has a return on equity of 0.61, a profit margin of 0.76, and total equity of $607,465. What is the net income? Question 7 2 pts U Question 7 2 pts A firm has sales of $412,250 and net income of $37,307. Currently, there are 33,285 shares outstanding at a market price of $39 per share. What is the price-sales ratio? Question 8 2 pts Computer Geeks sales of $350.423, a profit margin of 0.76, a total asset turnover rate of 3.51, and an equity multiplier of 1.92. What is the return on equity? Question 9 2 pts Waldale Pools has total equity of $989,824 and net income of $49,917. The debl-equity ratio is 0.02 and the total asset tumover is 2.72. What is the profit margin? Question 10 2 pts New Steel Products has total assets of $368,926, a total asset turnover rate of 2.93, a debt-equity ratio of 2.26, and a return on equity of 0.11. What is the firm's net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts