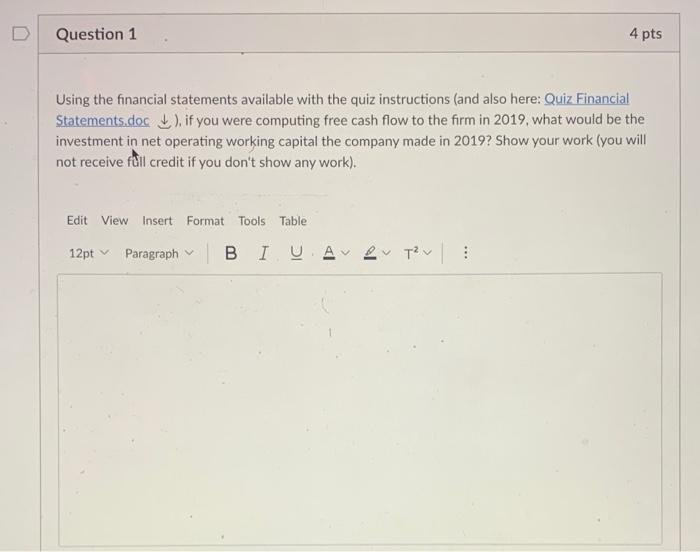

Question: D Question 1 4 pts Using the financial statements available with the quiz instructions (and also here: Quiz Financial Statements.doc .. if you were computing

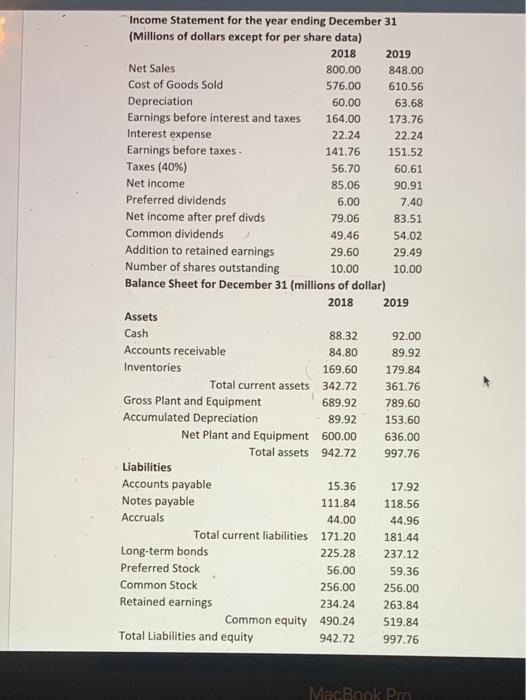

D Question 1 4 pts Using the financial statements available with the quiz instructions (and also here: Quiz Financial Statements.doc .. if you were computing free cash flow to the firm in 2019, what would be the investment in net operating working capital the company made in 2019? Show your work (you will not receive full credit if you don't show any work). Edit View Insert Format Tools Table 12pt Paragraph BIUA 2 T2 : Income Statement for the year ending December 31 (Millions of dollars except for per share data) 2018 2019 Net Sales 800.00 848.00 Cost of Goods Sold 576.00 610.56 Depreciation 60.00 63.68 Earnings before interest and taxes 164.00 173.76 Interest expense 22.24 22.24 Earnings before taxes 141.76 151.52 Taxes (40%) 56.70 60.61 Net income 85.06 90.91 Preferred dividends 6.00 7.40 Net income after pref divds 79.06 83.51 Common dividends 49.46 54.02 Addition to retained earnings 29.60 29.49 Number of shares outstanding 10.00 10.00 Balance Sheet for December 31 (millions of dollar) 2018 2019 Assets 88.32 92.00 Accounts receivable 84.80 89.92 Inventories 169.60 179.84 Total current assets 342.72 361.76 Gross Plant and Equipment 689.92 789.60 Accumulated Depreciation 89.92 153.60 Net Plant and Equipment 600.00 636.00 Total assets 942.72 997.76 Liabilities Accounts payable 15.36 17.92 Notes payable 111.84 118.56 Accruals 44.00 44.96 Total current liabilities 171.20 181.44 Long-term bonds 225.28 237.12 Preferred Stock 56.00 59.36 Common Stock 256.00 256.00 Retained earnings 234.24 263.84 Common equity 490.24 519.84 Total Liabilities and equity 942.72 997.76 Cash MacBook Pro D Question 1 4 pts Using the financial statements available with the quiz instructions (and also here: Quiz Financial Statements.doc .. if you were computing free cash flow to the firm in 2019, what would be the investment in net operating working capital the company made in 2019? Show your work (you will not receive full credit if you don't show any work). Edit View Insert Format Tools Table 12pt Paragraph BIUA 2 T2 : Income Statement for the year ending December 31 (Millions of dollars except for per share data) 2018 2019 Net Sales 800.00 848.00 Cost of Goods Sold 576.00 610.56 Depreciation 60.00 63.68 Earnings before interest and taxes 164.00 173.76 Interest expense 22.24 22.24 Earnings before taxes 141.76 151.52 Taxes (40%) 56.70 60.61 Net income 85.06 90.91 Preferred dividends 6.00 7.40 Net income after pref divds 79.06 83.51 Common dividends 49.46 54.02 Addition to retained earnings 29.60 29.49 Number of shares outstanding 10.00 10.00 Balance Sheet for December 31 (millions of dollar) 2018 2019 Assets 88.32 92.00 Accounts receivable 84.80 89.92 Inventories 169.60 179.84 Total current assets 342.72 361.76 Gross Plant and Equipment 689.92 789.60 Accumulated Depreciation 89.92 153.60 Net Plant and Equipment 600.00 636.00 Total assets 942.72 997.76 Liabilities Accounts payable 15.36 17.92 Notes payable 111.84 118.56 Accruals 44.00 44.96 Total current liabilities 171.20 181.44 Long-term bonds 225.28 237.12 Preferred Stock 56.00 59.36 Common Stock 256.00 256.00 Retained earnings 234.24 263.84 Common equity 490.24 519.84 Total Liabilities and equity 942.72 997.76 Cash MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts