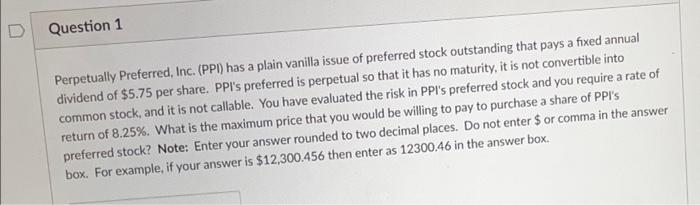

Question: D Question 1 Perpetually Preferred, Inc. (PPI) has a plain vanilla issue of preferred stock outstanding that pays a fixed annual dividend of $5.75 per

D Question 1 Perpetually Preferred, Inc. (PPI) has a plain vanilla issue of preferred stock outstanding that pays a fixed annual dividend of $5.75 per share. PPI's preferred is perpetual so that it has no maturity, it is not convertible into common stock, and it is not callable. You have evaluated the risk in PPI's preferred stock and you require a rate of return of 8.25%. What is the maximum price that you would be willing to pay to purchase a share of PPI's preferred stock? Note: Enter your answer rounded to two decimal places. Do not enter $ or comma in the answer box. For example, if your answer is $12,300.456 then enter as 12300.46 in the answer box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts