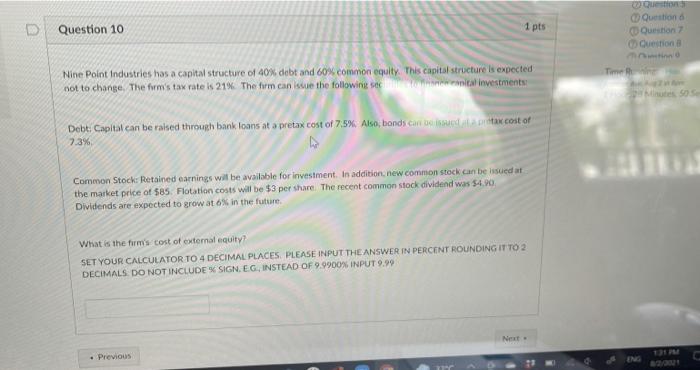

Question: D Question 10 1 pts Question Question Question Time Nine Point Industries has a capital structure of 40% debt and 60% common equity. This capital

D Question 10 1 pts Question Question Question Time Nine Point Industries has a capital structure of 40% debt and 60% common equity. This capital structure is expected not to change. The form's tax rate 21%The form can issue the following soal investments Debt Capital can be raised through bank loans at a pretax cost of 7,5%. Also, bonds can be made it cost of 7.3% Common Stock: Retained earnings will be available for investment. In addition, new common stock can be issued at the market price of 585 Flotation costs will be $3 per share. The recent common stock dividend was $4.90 Dividends are expected to grow at 6% in the future. What is the firm's cost of external equity? SET YOUR CALCULATOR TO 4 DECIMAL PLACES. PLEASE INPUT THE ANSWER IN PERCENT ROUNDING IT TO 2 DECIMALS DO NOT INCLUDESIGN. EG, INSTEAD OF 9.9900% INPUT 9.99 Next Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts