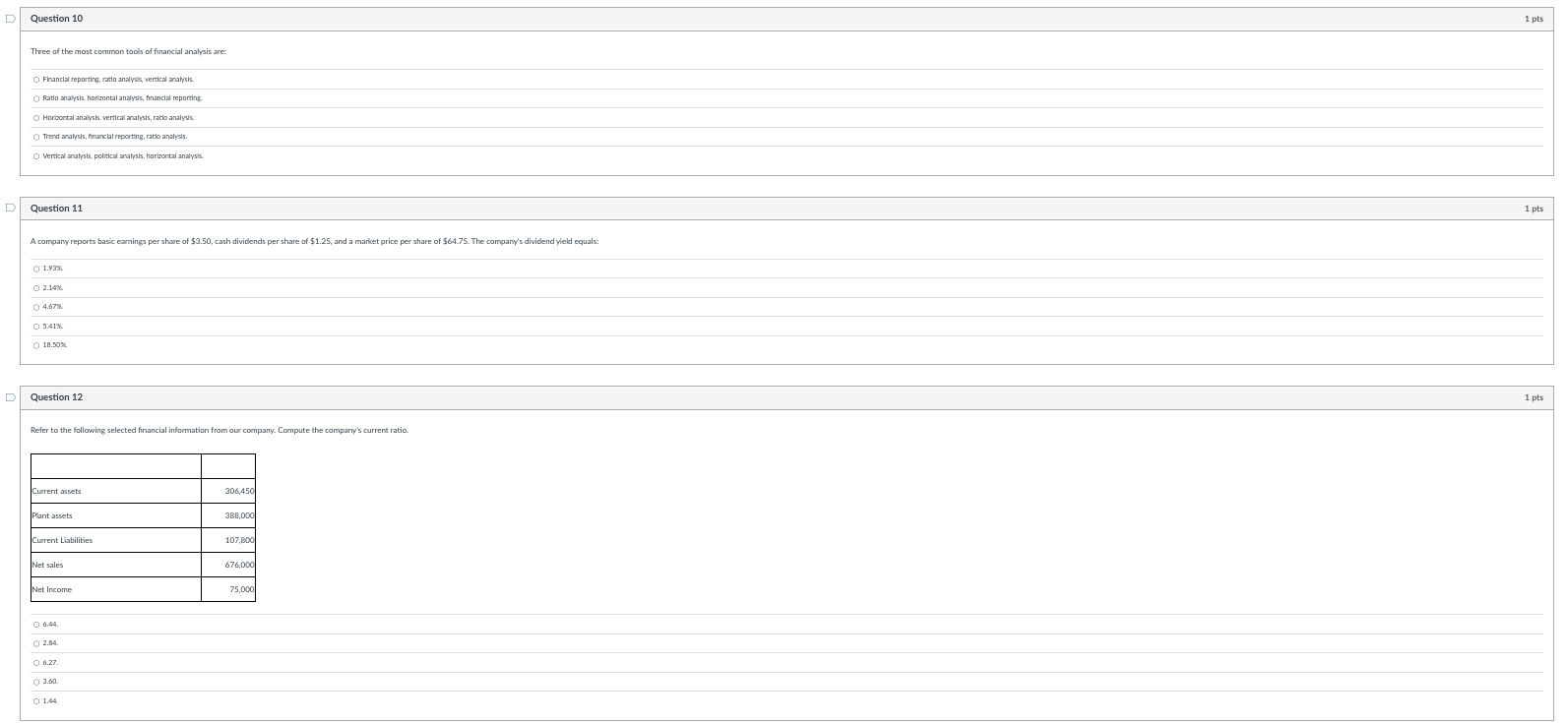

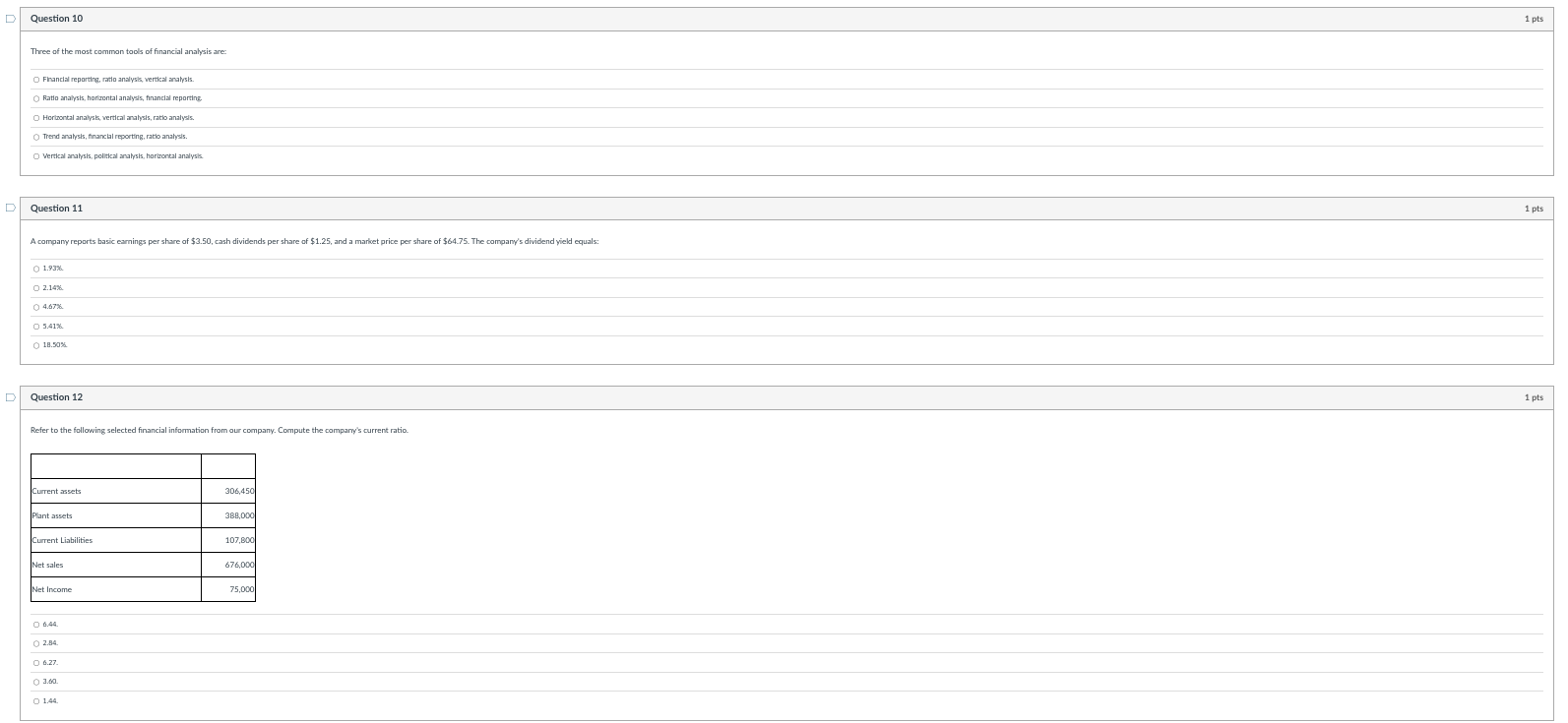

Question: D Question 10 1 pts Three of the most common tools of financial analysis are: O Financial reporting, ratio analysis, vertical analysis O Ratio analysis,

D Question 10 1 pts Three of the most common tools of financial analysis are: O Financial reporting, ratio analysis, vertical analysis O Ratio analysis, horizontal analysis, financial reporting. O Hortontal analysis, vertical analysis, ratio analysis. O Trend analysis, financial reporting, ratio analysis. O Vertical analysis, political analysis, horizontal analysis. D Question 11 1 pts A company reports basic earnings per share of $3.50, cash dividends per share of $1.25, and a market price per share of $64.75. The company's dividend yield equals: O 1.93%% ( 2.14%% 0 4.47%% 0 5.41% O 18.50% Question 12 1 pts Refer to the following selected financial information from our company. Compute the company's current ratio. Current assets 306,450 Plant assets BB,000 Current Liabilities 107,BOO et sales 476,000 et Income 75,000 5 6.44. O 2.84 O 6.27 O 3.60 D 1.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts