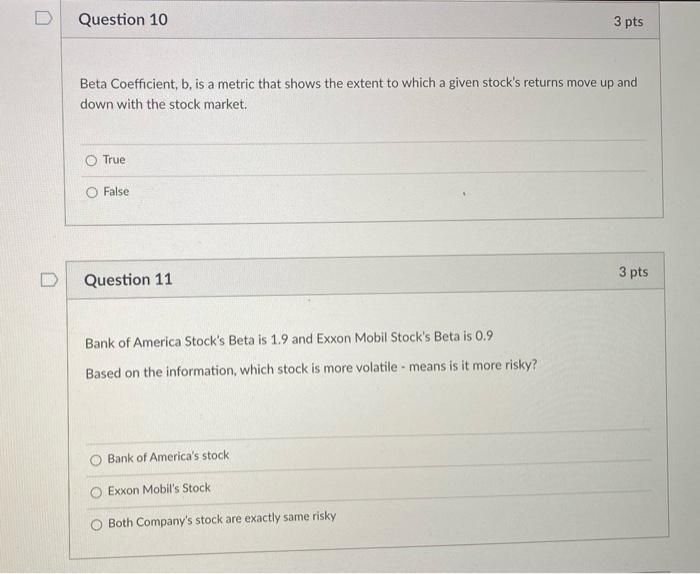

Question: D Question 10 3 pts Beta Coefficient, b, is a metric that shows the extent to which a given stock's returns move up and down

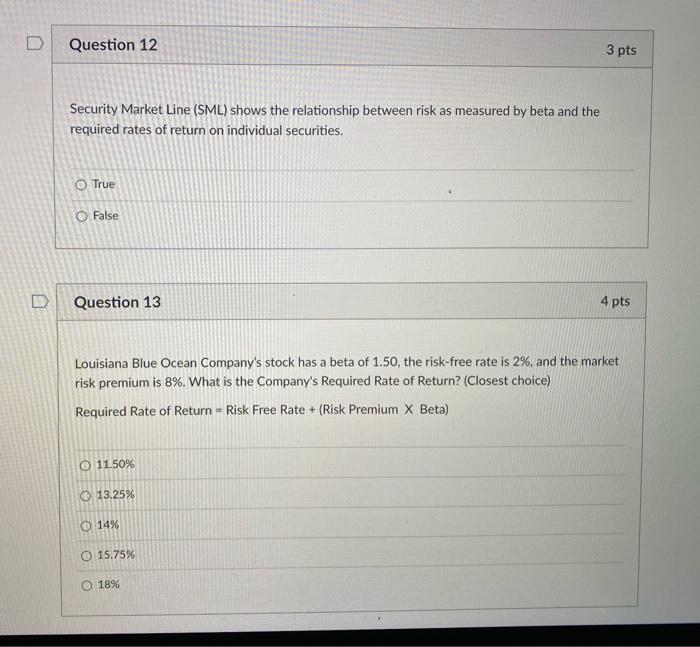

D Question 10 3 pts Beta Coefficient, b, is a metric that shows the extent to which a given stock's returns move up and down with the stock market. True False 3 pts Question 11 Bank of America Stock's Beta is 1.9 and Exxon Mobil Stock's Beta is 0.9 Based on the information, which stock is more volatile - means is it more risky? Bank of America's stock Exxon Mobil's Stock Both Company's stock are exactly same risky D Question 12 3 pts Security Market Line (SML) shows the relationship between risk as measured by beta and the required rates of return on individual securities. O True O False Question 13 4 pts Louisiana Blue Ocean Company's stock has a beta of 1.50, the risk-free rate is 2%, and the market risk premium is 8%. What is the Company's Required Rate of Return? (Closest choice) Required Rate of Return - Risk Free Rate + (Risk Premium X Beta) O 11.50% O 13.25% O 14% O 15.75% O 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts