Question: D Question 10 5 pts Ms. Z plans to construct several option portfolios. She is provided with following information of exchange-traded options on Company A's

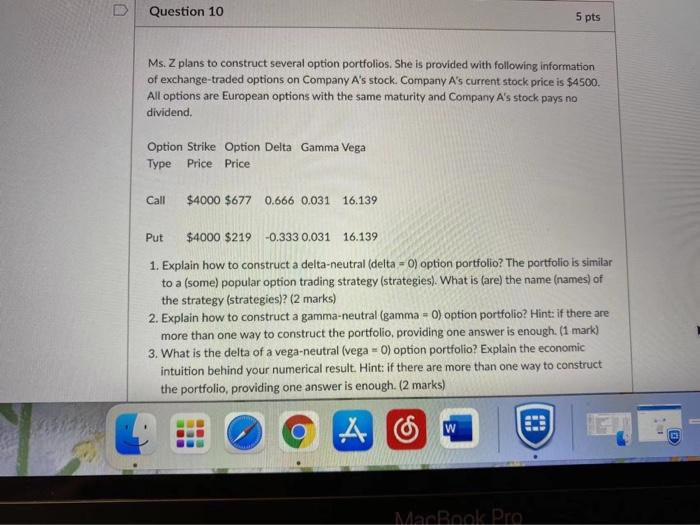

D Question 10 5 pts Ms. Z plans to construct several option portfolios. She is provided with following information of exchange-traded options on Company A's stock. Company A's current stock price is $4500. All options are European options with the same maturity and Company A's stock pays no dividend. Option Strike Option Delta Gamma Vega Type Price Price Call $4000 $677 0.666 0.031 16.139 Put $4000 $219 -0.333 0.031 16.139 1. Explain how to construct a delta-neutral (delta = 0) option portfolio? The portfolio is similar to a (some) popular option trading strategy (strategies). What is (are) the name (names) of the strategy (strategies)? (2 marks) 2. Explain how to construct a gamma-neutral (gamma = 0) option portfolio? Hint: if there are more than one way to construct the portfolio, providing one answer is enough. (1 mark) 3. What is the delta of a vega-neutral (vega = 0) option portfolio? Explain the economic intuition behind your numerical result. Hint: if there are more than one way to construct the portfolio, providing one answer is enough. (2 marks) ! W BE EEE g D MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts