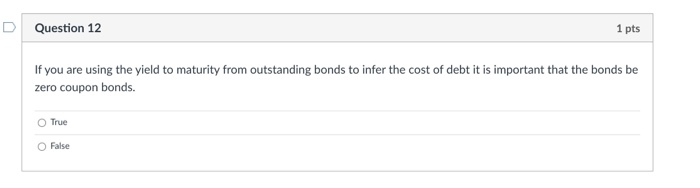

Question: D Question 12 1 pts If you are using the yield to maturity from outstanding bonds to infer the cost of debt it is important

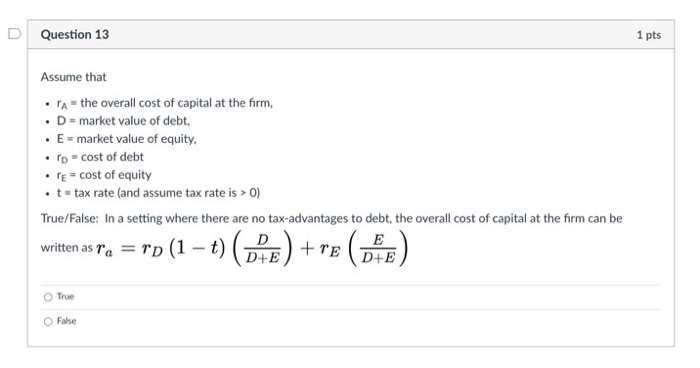

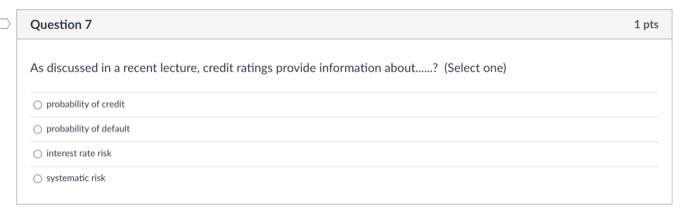

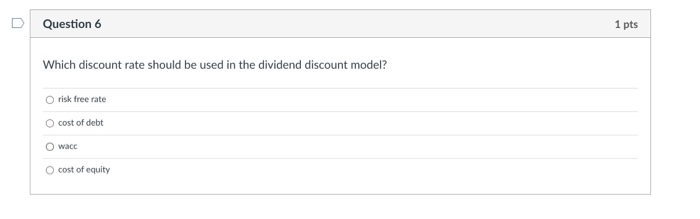

D Question 12 1 pts If you are using the yield to maturity from outstanding bonds to infer the cost of debt it is important that the bonds be zero coupon bonds. True O False D Question 13 1 pts Assume that A = the overall cost of capital at the firm, . D = market value of debt, E-market value of equity, . - cost of debt re = cost of equity t = tax rate (and assume tax rate is > 0) True/False: In a setting where there are no tax-advantages to debt, the overall cost of capital at the firm can be D D+E D+E written as ra = rp (1 t) ( Ee) +re ( True O False Question 7 1 pts As discussed in a recent lecture, credit ratings provide information about...? (Select one) O probability of credit probability of default interest rate risk O systematic risk Question 6 1 pts Which discount rate should be used in the dividend discount model? risk free rate O cost of debt O wacc O cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts