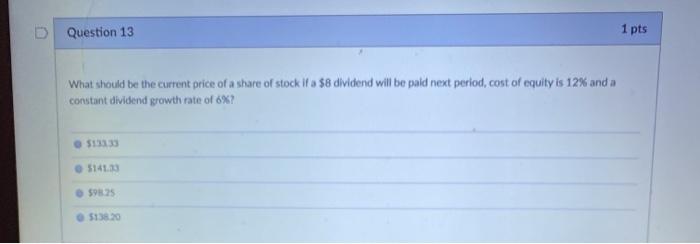

Question: D Question 13 1 pts What should be the current price of a share of stock if a $8 dividend will be paid next period,

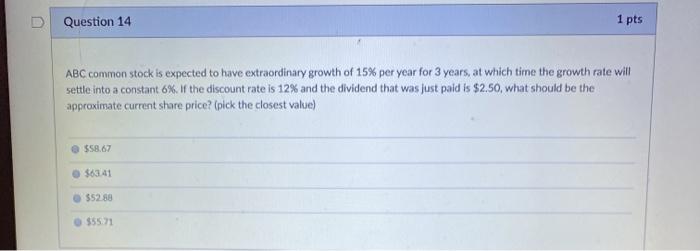

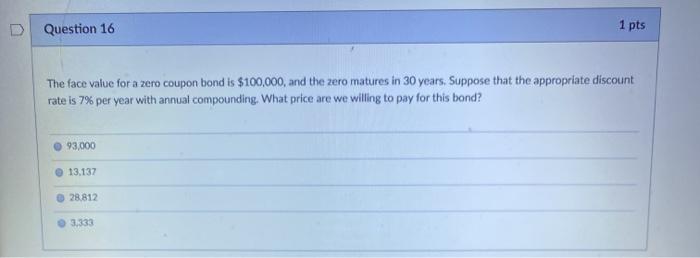

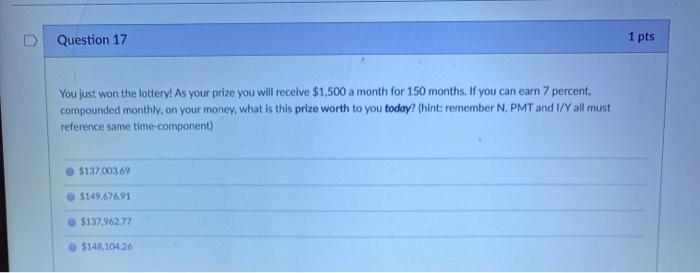

D Question 13 1 pts What should be the current price of a share of stock if a $8 dividend will be paid next period, cost of equity is 12% and a constant dividend growth rate of 6%? 513335 514130 598.25 5138.20 Question 14 1 pts ABC common stock is expected to have extraordinary growth of 15% per year for 3 years, at which time the growth rate will settle into a constant 6%. W the discount rate is 12% and the dividend that was just paid is $2.50, what should be the approximate current share price? (pick the closest value) $58.67 $63.41 $5288 $55.71 D Question 16 1 pts The face value for a zero coupon bond is $100,000, and the zero matures in 30 years. Suppose that the appropriate discount rate is 7% per year with annual compounding. What price are we willing to pay for this bond? 93,000 13.137 28.812 3.333 Question 17 1 pts You just won the lottery! As your prize you will receive $1.500 a month for 150 months. If you can earn 7 percent, compounded monthly, on your money, what is this prize worth to you today? (hint: remember N, PMT and I/Y all must reference same time-component) $137.003.69 $149.676.91 $137.962.77 5148,104.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts