Question: D Question 15 2 pts Consider a fixed-for-fixed 3-year currency swap. For company A, 3.5% on a US dollar principal of $200 million is received

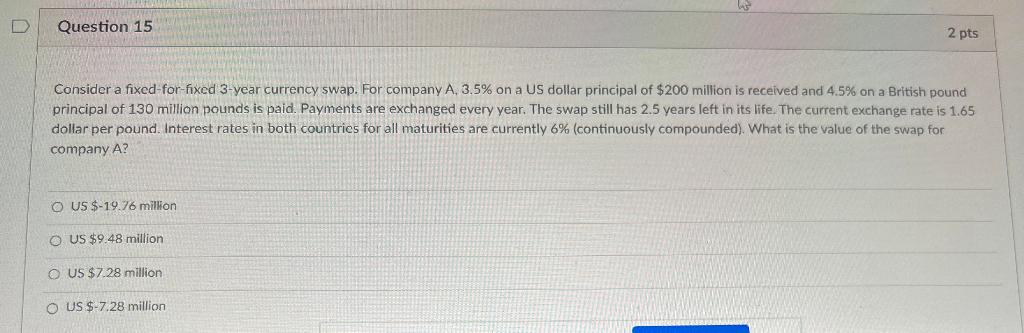

D Question 15 2 pts Consider a fixed-for-fixed 3-year currency swap. For company A, 3.5% on a US dollar principal of $200 million is received and 4.5% on a British pound principal of 130 million pounds is paid. Payments are exchanged every year. The swap still has 2.5 years left in its life. The current exchange rate is 1.65 dollar per pound. Interest rates in both countries for all maturities are currently 6% (continuously compounded). What is the value of the swap for company A? O US $-19.76 million O US $9.48 million O US $7.28 million US $-7.28 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts