Question: D Question 15 5 pts Horizon Group's stock has a required rate of return of 13.4%, and it sells for $87.50 per share, with a

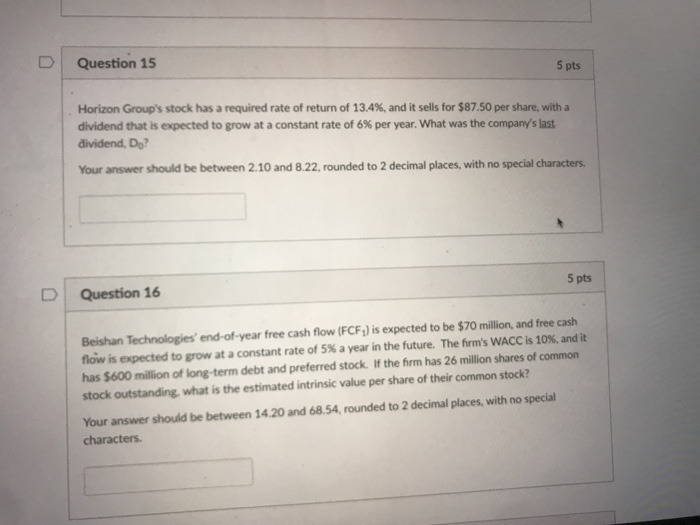

D Question 15 5 pts Horizon Group's stock has a required rate of return of 13.4%, and it sells for $87.50 per share, with a dividend that is expected to grow at a constant rate of 6% per year, what was the company's last dividend, Do Your answer should be between 2.10 and 8.22, rounded to 2 decimal places, with no special characters D Question 16 5 pts Beishan Technologies' end-of-year free cash flow (FCFs) is expected to be $70 million, and free cash flow is expected to grow at a constant rate of 5% a year in the future. The firm's WACC is 10%, and it has $600 million of long-term debt and preferred stock. If the firm has 26 million shares of common stock outstanding, what is the estimated intrinsic value per share of their common stock? Your answer should be between 14.20 and 68.54, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts