Question: D Question 16 3 pts The Simba Trust instrument provides that Mufasa, the sole income beneficiary, is to receive $40,000 annually. If trust accounting income

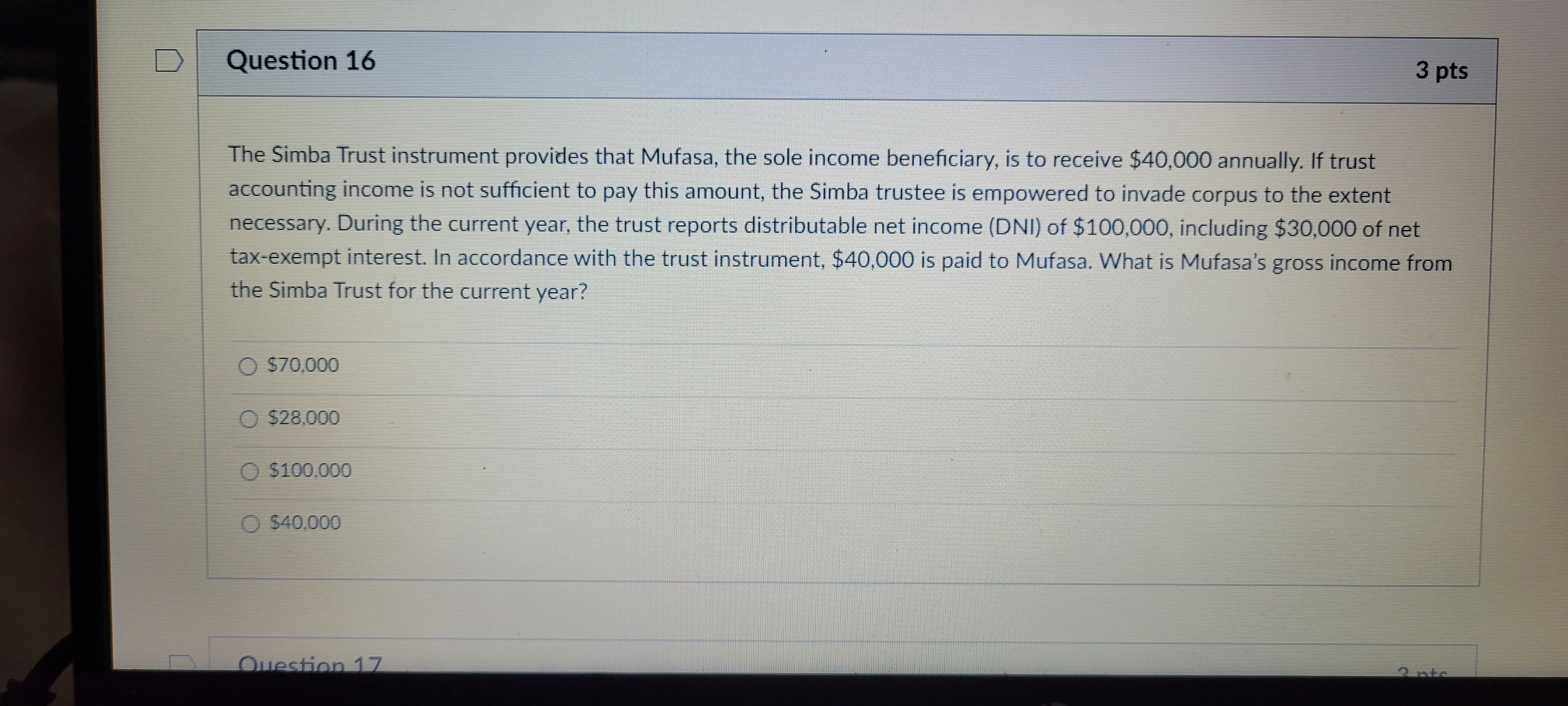

D Question 16 3 pts The Simba Trust instrument provides that Mufasa, the sole income beneficiary, is to receive $40,000 annually. If trust accounting income is not sufficient to pay this amount, the Simba trustee is empowered to invade corpus to the extent necessary. During the current year, the trust reports distributable net income (DNI) of $100,000, including $30,000 of net tax-exempt interest. In accordance with the trust instrument, $40,000 is paid to Mufasa. What is Mufasa's gross income from the Simba Trust for the current year? O $70,000 O $28,000 $100,000 $40,000 Question 17

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock