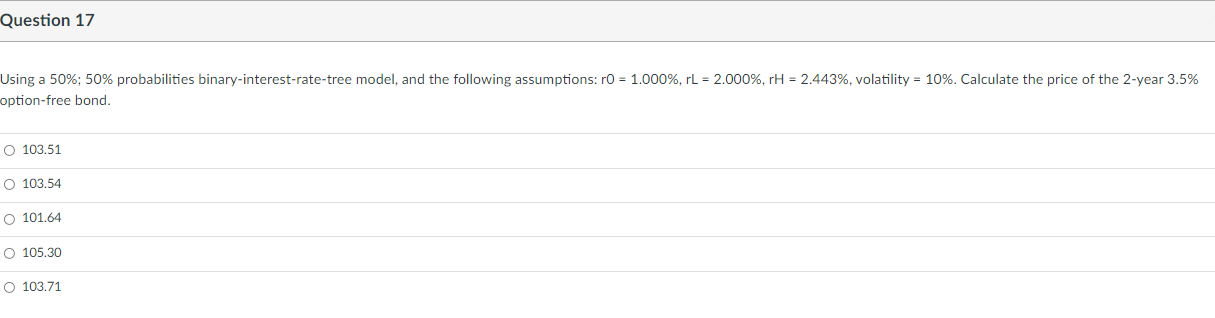

Question: D Question 17 1 pts Using a 50%; 50% probabilities binary-interest-rate-tree model, and the following assumptions: ro = 1.000%, rL = 2.000%, rH = 2.443%,

D Question 17 1 pts Using a 50%; 50% probabilities binary-interest-rate-tree model, and the following assumptions: ro = 1.000%, rL = 2.000%, rH = 2.443%, volatility = 10%. Calculate the price of the 2-year 3.5% option-free bond. O 103.51 O 103.54 O 101.64 O 105.30 O 103.71 Question 17 Using a 50%; 50% probabilities binary-interest-rate-tree model, and the following assumptions: r0 = 1.000%, rL = 2.000%,rH = 2.443%, volatility = 10%. Calculate the price of the 2-year 3.5% option-free bond. 103.51 O 103.54 101.64 O 105.30 O 103.71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts