Question: D Question 17 2 pts In a typical vanilla fixed-floating swap transaction, two parties agree to exchange: Maturity dates of obligations O money market funds

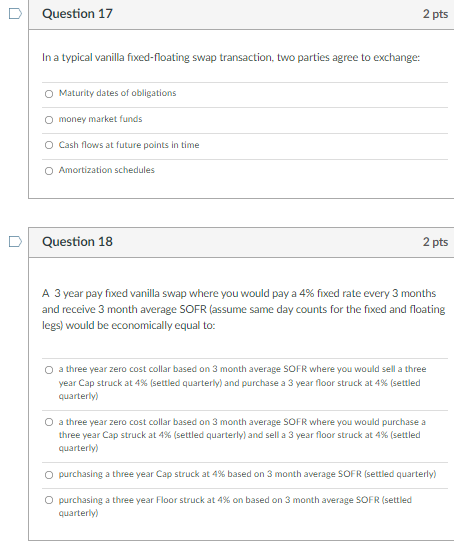

D Question 17 2 pts In a typical vanilla fixed-floating swap transaction, two parties agree to exchange: Maturity dates of obligations O money market funds O Cash flows at future points in time O Amortization schedules D Question 18 2 pts A 3 year pay fixed vanilla swap where you would pay a 4% fixed rate every 3 months and receive 3 month average SOFR (assume same day counts for the fixed and floating legs) would be economically equal to: O a three year zero cost collar based on 3 month average SOFR where you would sell a three year Cap struck at 4% (settled quarterly) and purchase a 3 year floor struck at 4% (settled quarterly! O a three year zero cost collar based on 3 month average SOFR where you would purchase a three year Cap struck at 4%% (settled quarterly) and sell a 3 year floor struck at 4%% (settled quarterly) O purchasing a three year Cap struck at 4% based on 3 month average SOFR (settled quarterly) O purchasing a three year Floor struck at 4% on based on 3 month average SOFR (settled quarterly)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts