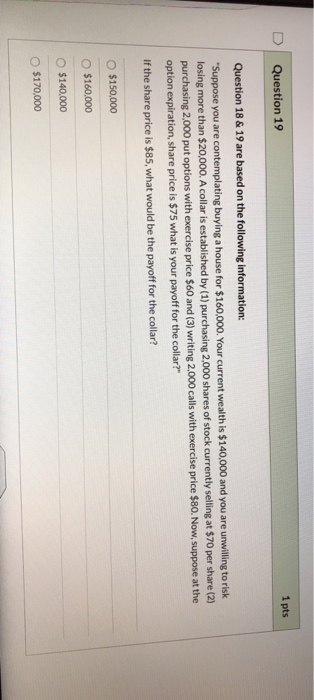

Question: D | Question 19 1 pts Question 18 & 19 are based on the following information: Suppose you are contemplating buying a house for $160.000.

D | Question 19 1 pts Question 18 & 19 are based on the following information: Suppose you are contemplating buying a house for $160.000. Your current wealth is $140,000 and you are unwilling to risk Suppose you are contemplating buying a house for $160,000. Your current losing more than $20,000. A collar is established by (1) purchasing option expiration, share price is $75 what is your payoff for the collar? purchasing 2,000 shares of stock currently selling at $70 per share (2) 2.000 put options with exercise price $60 and (3) writing 2.000 calls with exercise price $80. Now, suppose at the If the share price is $85, what would be the payoff for the collar? O $150,000 O $160,000 O $140000 O $170,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts