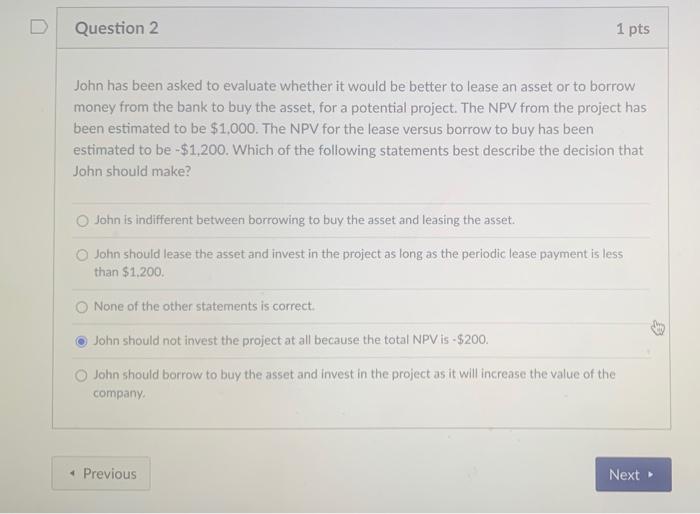

Question: D Question 2 1 pts John has been asked to evaluate whether it would be better to lease an asset or to borrow money from

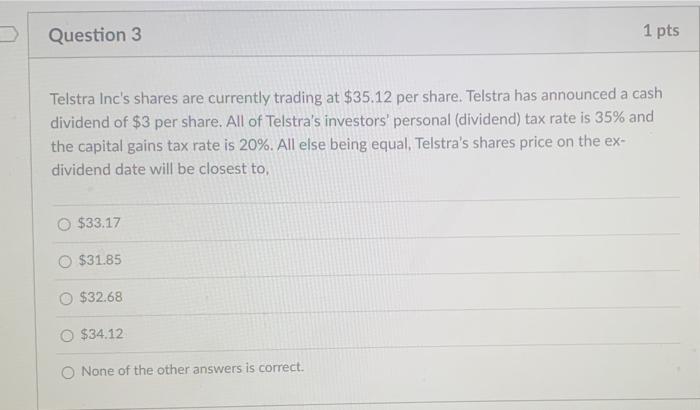

D Question 2 1 pts John has been asked to evaluate whether it would be better to lease an asset or to borrow money from the bank to buy the asset, for a potential project. The NPV from the project has been estimated to be $1,000. The NPV for the lease versus borrow to buy has been estimated to be -$1,200. Which of the following statements best describe the decision that John should make? John is indifferent between borrowing to buy the asset and leasing the asset. John should lease the asset and invest in the project as long as the periodic lease payment is less than $1,200 None of the other statements is correct. John should not invest the project at all because the total NPV is -$200, John should borrow to buy the asset and invest in the project as it will increase the value of the company Previous Next Question 3 1 pts Telstra Inc's shares are currently trading at $35.12 per share. Telstra has announced a cash dividend of $3 per share. All of Telstra's investors' personal (dividend) tax rate is 35% and the capital gains tax rate is 20%. All else being equal, Telstra's shares price on the ex- dividend date will be closest to, $33.17 $31.85 $32.68 $34.12 O None of the other answers is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts