Question: D Question 2 10 pts Stark Mining Ltd (SML) is an exclusive supplier of Valyrian Steel that recently reported Sales of $8 billion with a

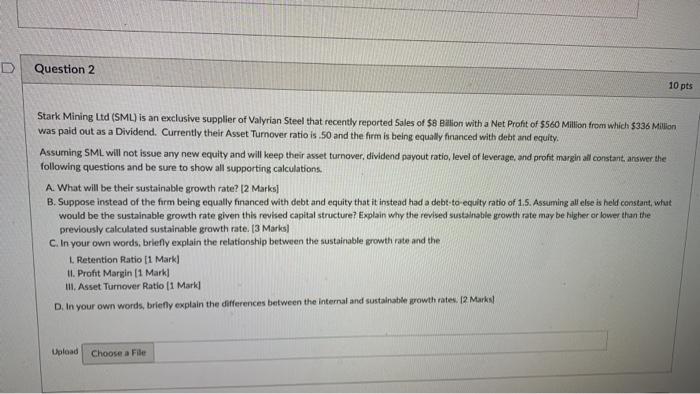

D Question 2 10 pts Stark Mining Ltd (SML) is an exclusive supplier of Valyrian Steel that recently reported Sales of $8 billion with a Net Profit of $560 Million from which $336 Million was paid out as a Dividend. Currently their Asset Turnover ratio is .50 and the firm is being equally financed with debt and equity. Assuming SML will not issue arvy new equity and will keep their asset turnover, dividend payout ratio, level of leverage and profit margin all constant answer the following questions and be sure to show all supporting calculations A. What will be their sustainable growth rate? 12 Marks] B. Suppose instead of the firm being equally financed with debt and equity that it instead had a debt to equity ratio of 1.5. Assuming all else is held constant, what would be the sustainable growth rate given this revised capital structure? Explain why the revised sustainable growth rate may be higher or lower than the previously calculated sustainable growth rate. (3 Marks) C. In your own words, briefly explain the relationship between the sustainable growth rate and the L. Retention Ratio 1 Mark) II. Profit Margin (1 mark] Ill. Asset Turnover Ratio (1 Mark D. In your own words, briefly explain the differences between the internal and sustainable growth rates, 12 Marks Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts