Question: D Question 25 21 pts Using the Excel template for question 25 that you downloaded from this module prior to starting this exam, prepare entries

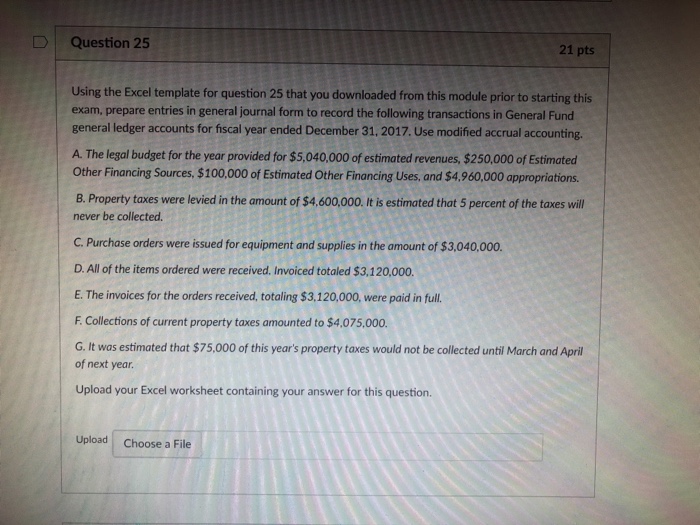

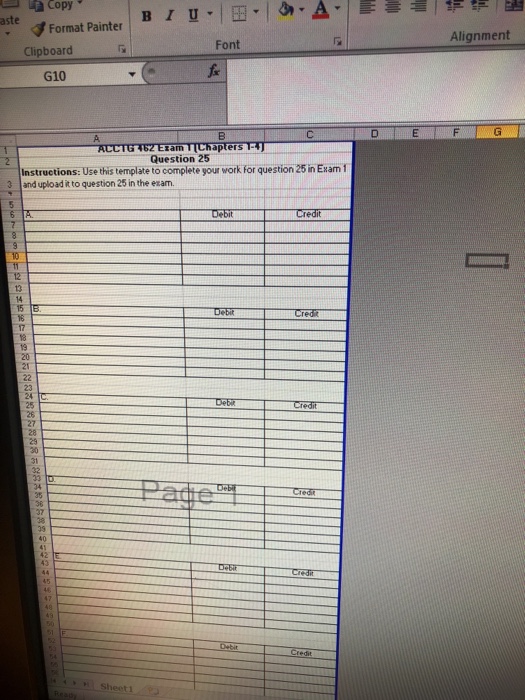

D Question 25 21 pts Using the Excel template for question 25 that you downloaded from this module prior to starting this exam, prepare entries in general journal form to record the following transactions in General Fund general ledger accounts for fiscal year ended December 31. 2017. Use modified accrual accounting. A. The legal budget for the year provided for $5,040,000 of estimated revenues, $250,000 of Estimated Other Financing Sources, $100,000 of Estimated Other Financing Uses, and $4.960,000 appropriations B. Property taxes were levied in the amount of $4,600,000. It is estimated that 5 percent of the taxes will never be collected C. Purchase orders were issued for equipment and supplies in the amount of $3040,000. D. All of the items ordered were received, Invoiced totaled $3,120,000. E. The invoices for the orders received, totaling $3,120,000, were paid in full F. Collections of current property taxes amounted to $4,075,000. G. It was estimated that $75,000 of this year's property taxes would not be collected until March and April of next year. Upload your Excel worksheet containing your answer for this question. Upload Choose a File D Question 25 21 pts Using the Excel template for question 25 that you downloaded from this module prior to starting this exam, prepare entries in general journal form to record the following transactions in General Fund general ledger accounts for fiscal year ended December 31. 2017. Use modified accrual accounting. A. The legal budget for the year provided for $5,040,000 of estimated revenues, $250,000 of Estimated Other Financing Sources, $100,000 of Estimated Other Financing Uses, and $4.960,000 appropriations B. Property taxes were levied in the amount of $4,600,000. It is estimated that 5 percent of the taxes will never be collected C. Purchase orders were issued for equipment and supplies in the amount of $3040,000. D. All of the items ordered were received, Invoiced totaled $3,120,000. E. The invoices for the orders received, totaling $3,120,000, were paid in full F. Collections of current property taxes amounted to $4,075,000. G. It was estimated that $75,000 of this year's property taxes would not be collected until March and April of next year. Upload your Excel worksheet containing your answer for this question. Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts