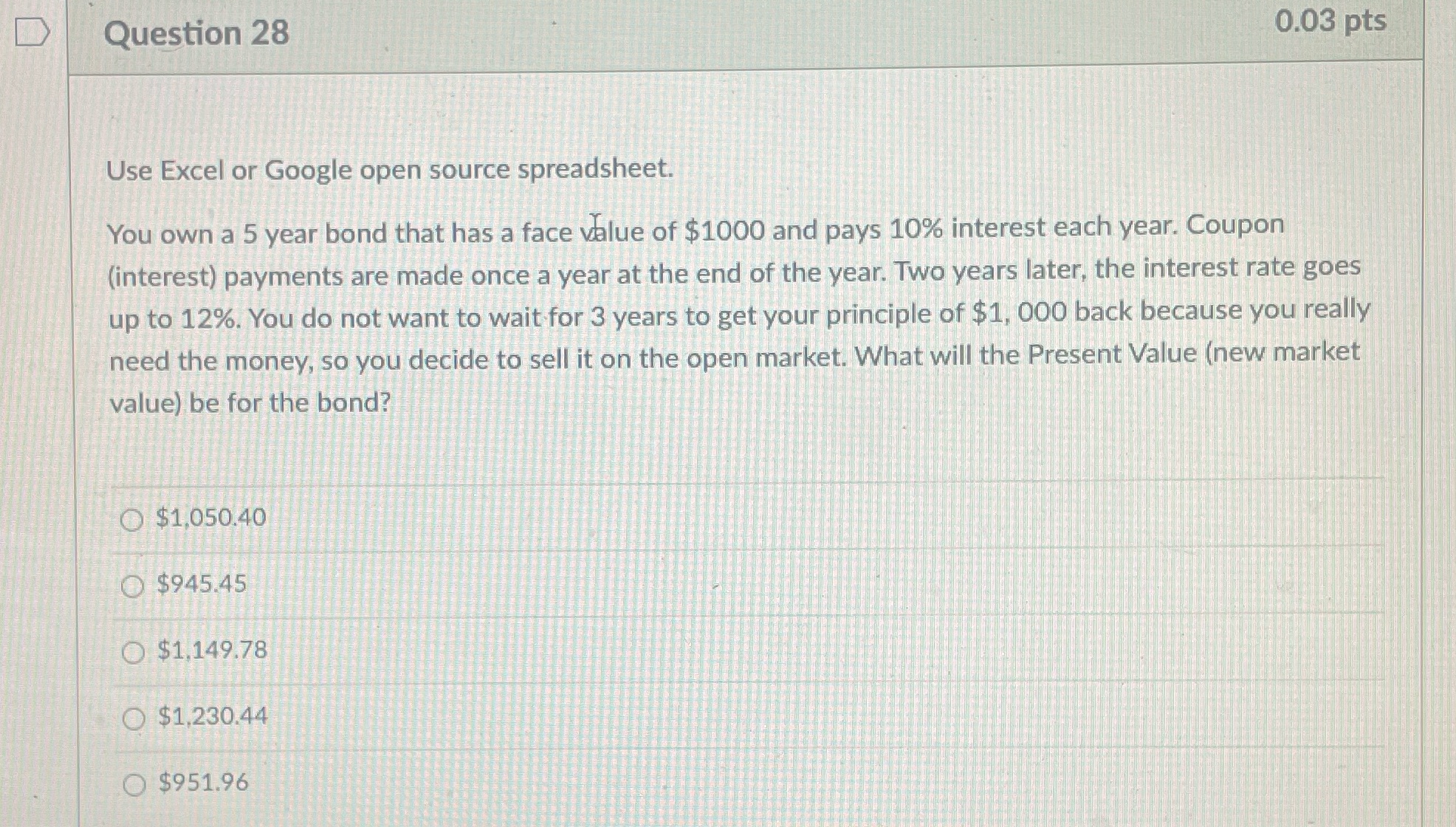

Question: D Question 28 0.03 pts Use Excel or Google open source spreadsheet. You own a 5 year bond that has a face value of $1000

D Question 28 0.03 pts Use Excel or Google open source spreadsheet. You own a 5 year bond that has a face value of $1000 and pays 10% interest each year. Coupon (interest) payments are made once a year at the end of the year. Two years later, the interest rate goes up to 12%. You do not want to wait for 3 years to get your principle of $1, 000 back because you really need the money, so you decide to sell it on the open market. What will the Present Value (new market value) be for the bond? $1,050.40 O $945.45 O $1,149.78 $1,230.44 O $951.96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts