Question: D Question 3 1 pts After saving for a few years, you decide to buy a home together. You take on a new mortgage of

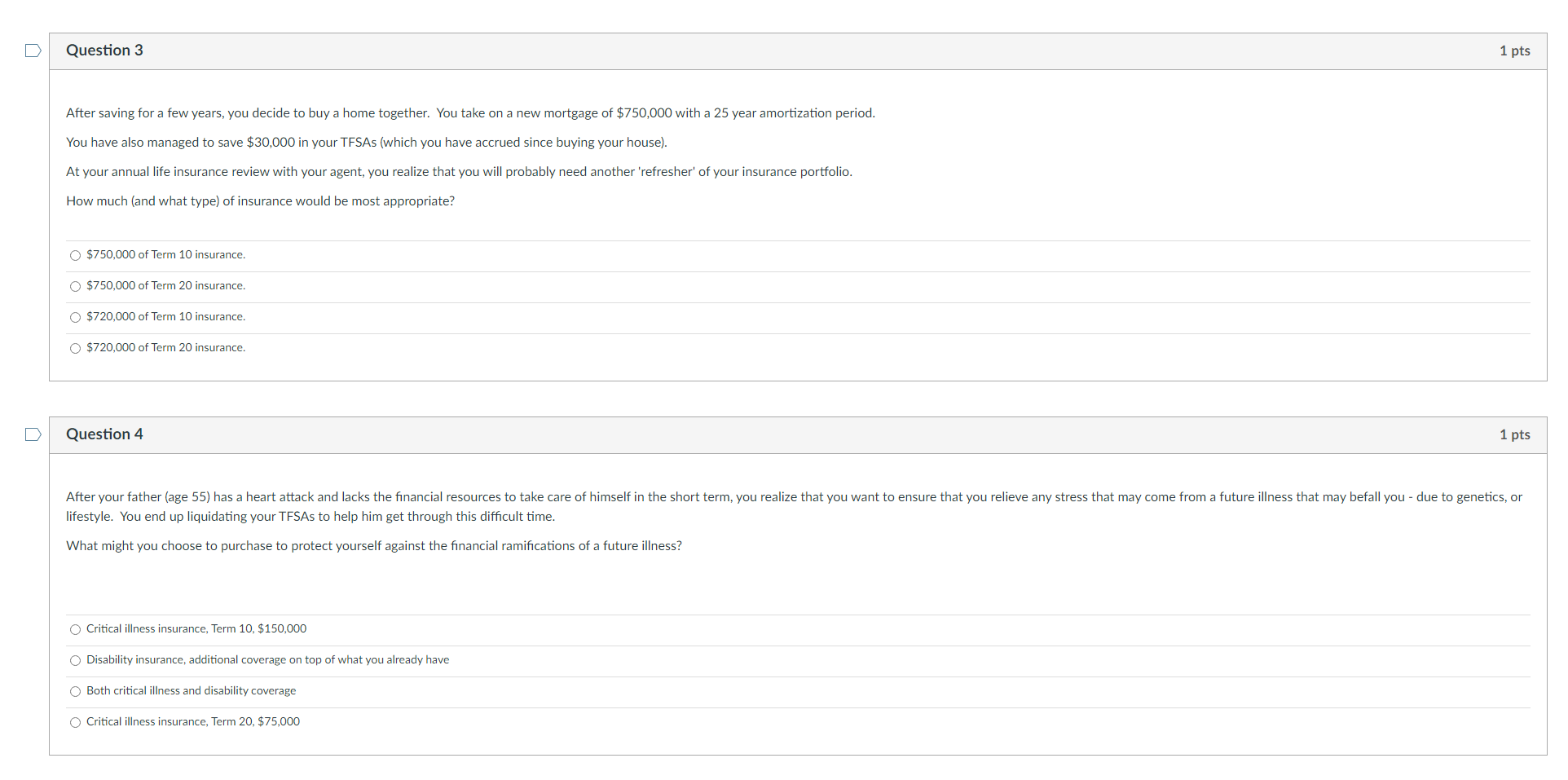

D Question 3 1 pts After saving for a few years, you decide to buy a home together. You take on a new mortgage of $750,000 with a 25 year amortization period. You have also managed to save $30,000 in your TFSAs (which you have accrued since buying your house). At your annual life insurance review with your agent, you realize that you will probably need another 'refresher' of your insurance portfolio. How much (and what type) of insurance would be most appropriate? $750,000 of Term 10 insurance. O $750,000 of Term 20 insurance. O $720,000 of Term 10 insurance. O $720,000 of Term 20 insurance. Question 4 1 pts After your father (age 55) has a heart attack and lacks the financial resources to take care of himself in the short term, you realize that you want to ensure that you relieve any stress that may come from a future illness that may befall you - due to genetics, or lifestyle. You end up liquidating your TFSAs to help him get through this difficult time. What might you choose to purchase to protect yourself against the financial ramifications of a future illness? Critical illness insurance, Term 10, $150,000 O Disability insurance, additional coverage on top of what you already have Both critical illness and disability coverage Critical illness insurance, Term 20, $75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts