Question: D Question 3 1 pts Malholtra Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR?

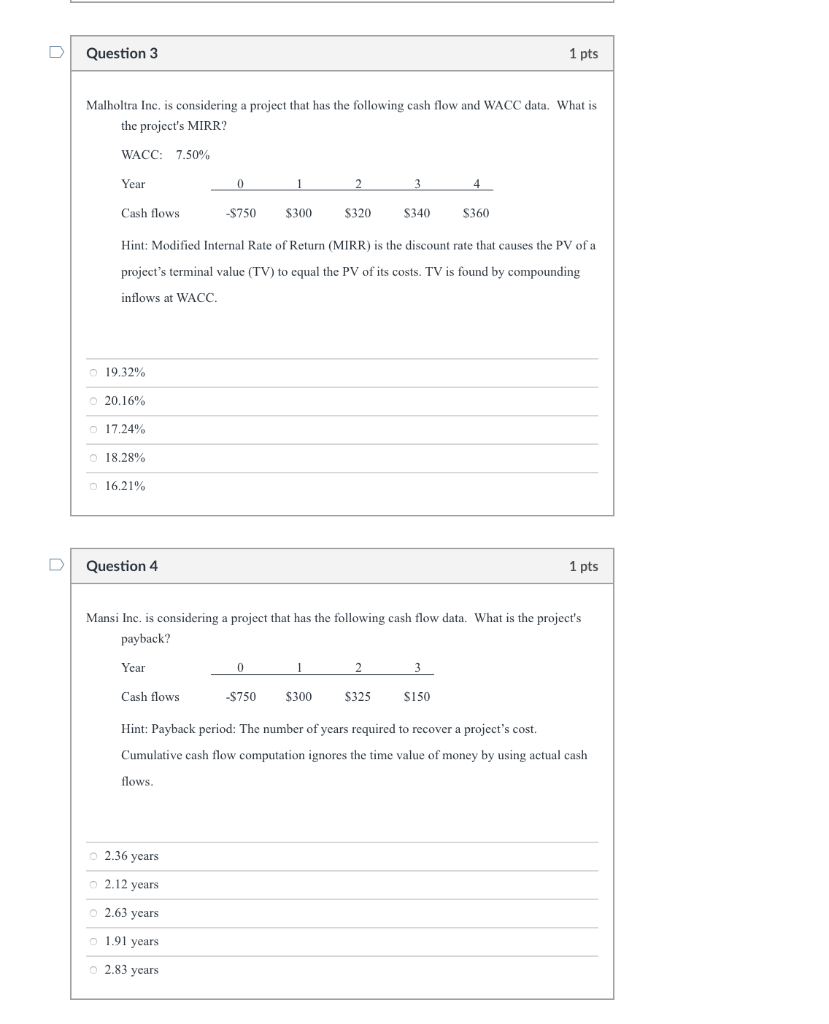

D Question 3 1 pts Malholtra Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC: 7.50% Year 0 3 4 Cash flows -S750 $300 $320 S340 S360 Hint: Modified Internal Rate of Return (MIRR) is the discount rate that causes the PV of a project's terminal value (TV) to equal the PV of its costs. TV is found by compounding inflows at WACC. 19.32% 20.16% 17.24% O 18.28% 16.21% Question 4 1 pts Mansi Inc. is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 Cash flows -$750 $300 $325 S150 Hint: Payback period: The number of years required to recover a project's cost. Cumulative cash flow computation ignores the time value of money by using actual cash flows. 2.36 years 2.12 years 2.63 years 1.91 years 2.83 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts