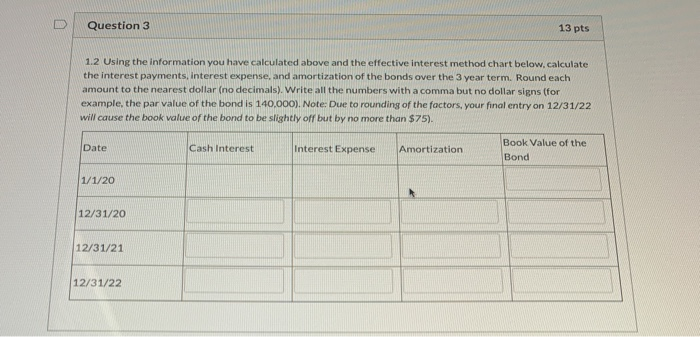

Question: D Question 3 13 pts 1.2 Using the information you have calculated above and the effective interest method chart below, calculate the interest payments, interest

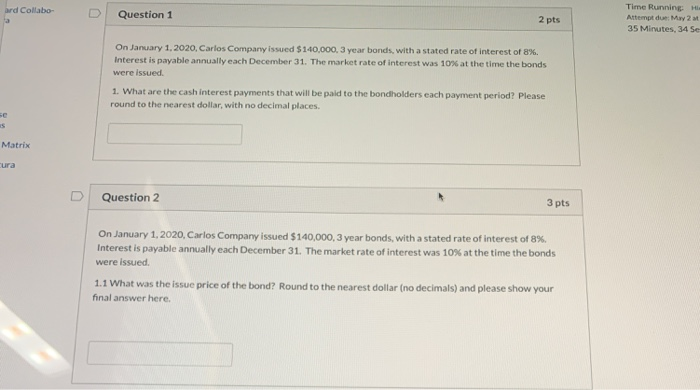

D Question 3 13 pts 1.2 Using the information you have calculated above and the effective interest method chart below, calculate the interest payments, interest expense, and amortization of the bonds over the 3 year term. Round each amount to the nearest dollar (no decimals). Write all the numbers with a comma but no dollar signs for example, the par value of the bond is 140.000). Note: Due to rounding of the factors, your final entry on 12/31/22 will cause the book value of the bond to be slightly off but by no more than $75) Date Cash Interest Interest Expense Amortization Book Value of the Bond 1/1/20 12/31/20 12/31/21 12/31/22 wrd Collabo D Question 1 2 pts Time Running Attempt du M2 35 Minutes, 34 54 On January 1, 2020, Carlos Company issued $140,000, 3 year bonds, with a stated rate of interest of 8%. Interest is payable annually each December 31. The market rate of interest was 10% at the time the bonds were issued 1. What are the cash interest payments that will be paid to the bondholders each payment period? Please round to the nearest dollar, with no decimal places Matrix Question 2 3 pts On January 1, 2020, Carlos Company issued $140,000, 3 year bonds, with a stated rate of interest of 8%. Interest is payable annually each December 31. The market rate of interest was 10% at the time the bonds were issued 1.1 What was the issue price of the bond? Round to the nearest dollar (no decimals) and please show your final answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts